Holistic Financial Inclusion Based on Maqashid Shariah Through Baitul Maal Wat Tamwil

By Ascarya

Abstract

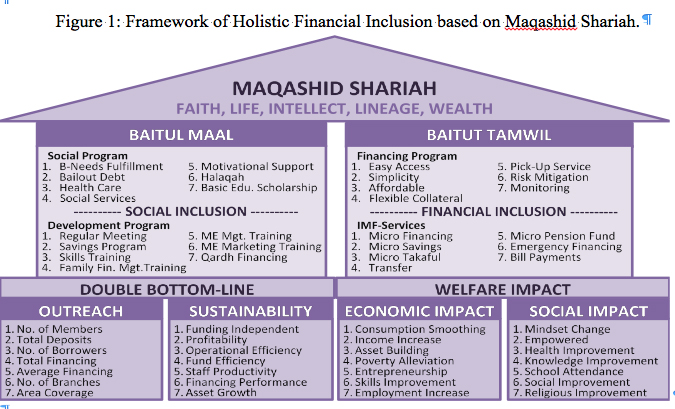

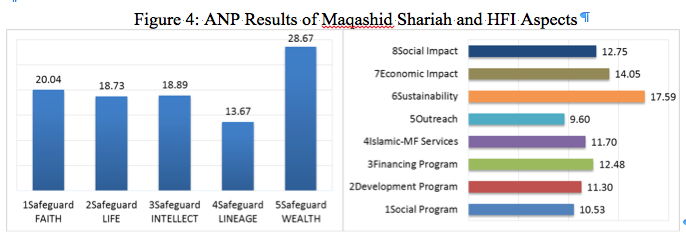

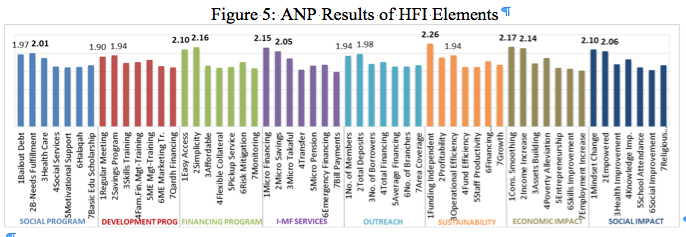

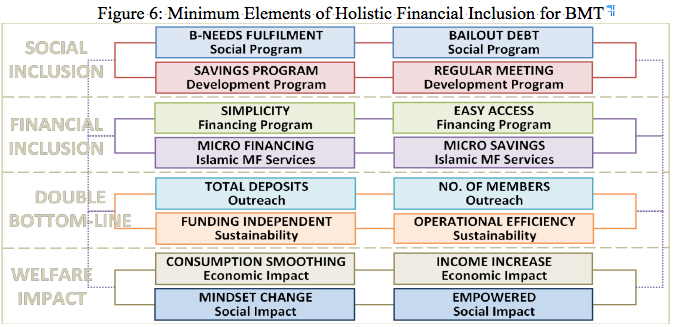

Holistic financial inclusion (HFI), an integration of social inclusion delivered by not-for-profit MFIs and financial inclusion delivered by for-profit MFIs, is actually not a new concept in Islamic perspective. This study aims to develop holistic financial inclusion based on Maqashid Shariah through Baitul Maal wat Tamwil (BMT) using Analytic Network Process (ANP), by acquiring the knowledge of nine experts and nine BMT practitioners. The results show that the most important Maqashid Shariah to be achieved by HFI are safeguarding the wealth (28.7%), since poverty leads to infidelity (Imam Al-Bayhaqi), to preserve safeguarding the faith (20.0%), which is in line with the objective of Islamic social tools, especially zakat, infaq, shadaqah and waqf (ZISWaf), to alleviate poverty, as well as to empower the poor (mustahiq). The most important aspects of HFI are the commercial objective of financial sustainability (17.59%), followed by economic impact (14.05%) and social impact (12.75%), financing programs (12.48%) and Islamic microfinance services (11.70%), development program (11.30%) and social programs (10.53%). The social objective of poverty outreach (9.60%) is the least important. The most important elements of HFI are funding independent (2.26%), consumption smoothing (2.17%), simplicity (2.16%), micro financing (2.15%) and income increase (2.14%), followed by easy access (2.10%), mindset change (2.10%), empower (2.06%), micro savings (2.05%) and basic needs fulfillment (2.01%). The design of BMT-HFI should also have Social Inclusion (basic needs fulfilment, bailout of debt, savings programs and regular meeting), as well as Financial Inclusion (simplicity, easy access, micro financing and micro savings) to achieve Double Bottom-line (total deposits, number of members, funding independent and operational efficiency), as well as Welfare Impact (consumption smoothing, income increase, mindset change and empowerment). Mindset change of the poor (mustahiq), as the one of most important HFI elements of all, is very important to inspire them to transform.

Keywords: Social Inclusion, Financial Inclusion, Holistic Financial Inclusion, Baitul Maal wat Tamwil

The idea of financial inclusion arose in response to the financial exclusion of the disadvantaged and low income groups of society, especially the poor. The principal objective was to alleviate poverty (Leyshon and Thrift, 1995). Financial inclusion to alleviate poverty through conventional microfinance institutions (CMFI), however, presents certain problems, such as financial sustainability and institutional “mission drift” (Frank and Lynch, 2008; Ghosh and Tassel, 2008; Armendariz and Morduch, 2010; Armendariz, et al., 2011; Zeller and Meyer, 2002).

CMFIs in fact have a “double bottom line” or twin goals of not only high outreach to the poor, but also of financial sustainability. Mission drift means that CMFI has been moving away from its original objective of poverty alleviation due to formalization (Frank and Lynch, 2008), commercialization (Ghosh and Tassel, 2008; Hamada, 2010; Abrar and Javaid, 2014), financial sustainability (Augsburg and Fouillet, 2010; Wagenar, 2012) and high operational costs (Cerano-Cinca and Gutierrez-Nieto, 2012). One solution proposed by Battilana and Dorado (2010) was to build sustainable hybrid organization, combining development logic to help the poor and banking logic to be financially self-sufficient.

Moreover, Zeller and Meyer (2002) believed that due to shifts in paradigms, strategies, and development practices in the 1990s, microfinance really confronted not two but three overarching policy objectives, namely financial sustainability, outreach to the poor and a positive impact on welfare that outreach to the poor did not necessarily achieve. Although MFIs tried to achieve these objectives, many of them stressed one particular objective over the other two.

In the Islamic perspective, financial inclusion is an integral part of Islamic microfinance institutions (IMFI), which were designed to provide various Islamic financial products and services needed by low income and poor groups of society. Islamic microfinance provides a more holistic framework than conventional microfinance in enhancing financial inclusion, eradicating poverty, and promoting a healthy economy through microfinance, MSE financing, and micro insurance (Naceur, 2015). The concept of financial inclusion in the Islamic perspective is based on two main pillars, namely redistributive and risk sharing instruments (Mohieldin, et al., 2012; Iqbal and Mirakhor, 2012 and 2013; Iqbal, 2014), and they encourage social as well as financial inclusion.

One well known type of Islamic microfinance institution (IMFI) in Indonesia is Baitul Maal wat Tamwil (house of wealth and business) or BMT. Baitul Maal (Bait = House, al-Maal = Wealth) focuses on social inclusion as it collects compulsory taxes and voluntary charities, such as zakat, infaq, sadaqah, awqaf, and then optimizes their distribution by applying Shariah based management. Meanwhile, Baitul Tamwil (Bait = House, at-Tamwil = Finance/capital) focuses on financial inclusion by developing productive businesses and investing in micro and small scale economy.

This study aims to design the model of holistic financial inclusion (HFI), which includes social inclusion and financial inclusion by BMT to empower the poor to step gradually from extreme poverty to some form of economic activity, eventually as an independent micro entrepreneur. This study uses the Analytic Network Process (ANP) with 9 experts and 9 practitioners as respondents, while the framework as can be seen in figure 1.

ANP is described by its inventor Thomas L. Saaty as a multicriteria theory of measurement used to derive relative priority scales of absolute numbers from individual judgments (or from actual measurements normalized to a relative form) that also belong to a fundamental scale of absolute numbers. The ANP provides a general framework to deal with decisions without making assumptions about the independence of higher-level elements from lower level elements and about the independence of the elements within a level as in a hierarchy. In fact the ANP uses network analysis without the need to specify levels (Saaty, 2005).

The ANP was developed to analyze the feedback networks of the Analytic Hierarchy Process. (Saaty and Vargas, 2006, p.2). In AHP, problems are illustrated as a linear top down structure with no feedback from lower to higher levels. In ANP, problems are structured as a network and it provides feedback among clusters. Problems could not always be structured hierarchically as in AHP, because they involve dependence, interaction and feedback among higher level clusters and lower level clusters, and among clusters in the same level (Saaty and Vargas, 2006, p.7).

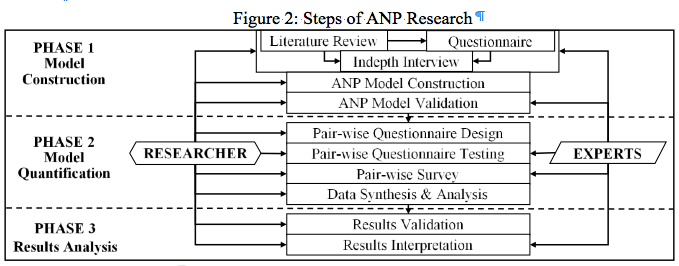

There are three steps or phases to be done in ANP (Ascarya, 2014), namely model construction, model quantification and results analysis (see figure 2).

Source: Ascarya (2014)

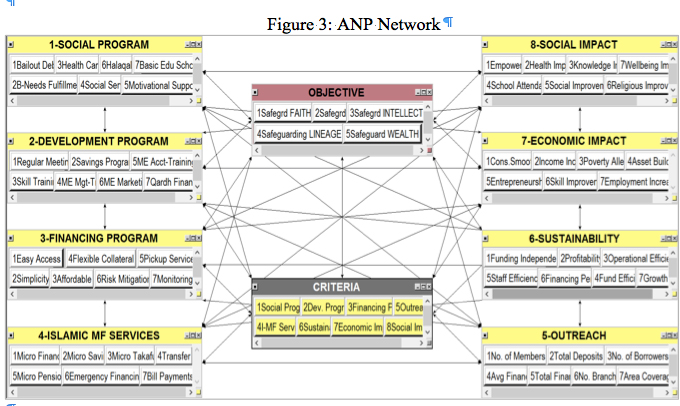

Phase 1 is model construction or decomposition to identify, analyze and structure the complexity of the problems into an appropriate ANP network, which includes: a) Literature reviews, questionnaires and in-depth interviews with experts and practitioners to comprehend the problem fully; b) Construction of ANP network based on information gathered, as summarized in figure 1; and c) Validation of ANP network with experts. The result is ANP network as in figure 3.

Phase 2 is model quantification or pair-wise comparison, which includes: a) Design pair-wise questionnaires in accordance with ANP network; b) Test the pair-wise questionnaires with expert respondents; c) Survey to selected experts and practitioners respondents to fill out pair-wise questionnaires; and d) Data processing and synthesis using ANP software SUPERDECISIONS, which includes checking the consistency, obtaining group judgment by calculating the geometric mean of all respondents’ responses, and obtaining priorities.

Phase 3 is results analysis where outputs are manipulated in a separate excel file, which includes: a) calculation and presentation of general priorities and detailed results; b) Validation of the results; and c) Interpretations of the results.

Results

The overall results show that safeguarding WEALTH (28.67%) is the most important Islamic objective, followed by safeguarding FAITH (20.04%), safeguarding the INTELLECT (18.89%), safeguarding LIFE (18.73%) and safeguarding LINEAGE (13.67%). The most important aspect of HFI is the commercial objective of financial sustainability (17.59%), followed by economic impact (14.05%) and social impact (12.75%), financing programs (12.48%) and Islamic microfinance services (11.70%), and social programs (10.53%). The social objective of poverty outreach (9.60%) is the least important (see figure 4, right).

Moreover, the most important elements of HFI (above 2.00%) are funding independent (2.26%), consumption smoothing (2.17%), simplicity (2.16%), micro financing (2.15%) and income increase (2.14%), followed by easy access (2.10%), mindset change (2.10%), empowered (2.06%), micro savings (2.05%) and basic needs fulfilment (2.01%). The most important elements by cluster (see figure 5) are bailout debt and basic needs fulfilment (Social Program), regular meetings and savings programs (Development Program), simplicity and easy access (Financing Program), micro savings and micro financing (I-MF Services), number of members and total deposits (Outreach), funding independent and profitability (Sustainability), consumption smoothing and income increase (Economic Impact), mindset change and empowered (Social Impact).

Recommendation

Baitul Maal wat Tamwil could become the most suitable IMFI to carry out holistic financial Inclusion (HFI), which should comprise social inclusion (including social program and development programs) using social/ZISWaf funds carried out by Bait al-Maal, and financial inclusion (including financing programs and Islamic microfinance services) using commercial funds carried out by Bait at-Tamwil. Social inclusion must have the minimum elements of Basic Needs Fulfillment and Bailout Debt (Social Program), as well as Savings Program and Regular Meeting (Development Program), while financial inclusion must have the minimum elements of Simplicity and Easy Access (Financing Program), as well as Micro Financing and Micro Savings (Islamic Microfinance Services).

HFI should be able simultaneously to achieve the three objectives of microfinance, namely the social one of Outreach to the Poor, the commercial one of Financial Sustainability, and the Welfare Impact (Economic Impact and Social Impact). Outreach to the Poor must have minimum elements of Total Deposits and Number of Members, while Financial Sustainability must have minimum elements of Funding Independence and Operational Efficiency. Economic Impact must have minimum elements of Consumption Smoothing and Income Increase, while Social Impact must have minimum elements of Mindset Change and Empower.

Ascarya is a Senior Researcher at Department of Islamic Economic and Finance, Bank Indonesia. He is a managing editor of scientific Islamic Journal by Bank Indonesia, as well as reviewer of several National and International Journals. He is also a visiting lecturer and experts in the field of Islamic Economics, Monetary, Banking and Microfinance in several universities. He has received PhD in Islamic Economics and Finance from IEF-Trisakti University, Indonesia, as well as PhD Candidate in International Development, MBA in Finance and MSc in Management Information System from University of Pittsburgh, USA. He has produced 9 12 international journals and books, 55 international papers, 21 national journals, 22 national papers, 31 working papers, 3 occasional papers, 17 books, 2 proceedings, 11 periodical publications, and 6 research notes. He has presented in 29 international conferences and 73 national conferences. He has received three International Best Paper Awards in 2013, 2014 and 2015.

References

Abrar, A. and A.Y. Javaid. “Commercialization and Mission DriftA Cross Country Evidence on Transformation of Microfinance Industry”, International Journal of Trade, Economics and Finance, 5(1) (2014): 122-125.

Armendariz, B. and J. Morduch. The Economics of Microfinance, 2nd ed. (The MIT Press: London, 2010).

Armendariz, B., B. D’Espallier, M. Hudon, and A. Szafarz. “Subsidy Uncertainty and Microfinance Mission Drift,” CEB Working Paper, No. 11, (2011): 1-42.

Ascarya. “Sustainable Conventional and Islamic Microfinance Models for Micro Enterprises”, ISRA International Journal of Islamic Finance, 6(2), (2014): 49-85.

Frank, C. and E. Lynch. Stemming the Tide of Mission Drift: Microfinance Transformations and the Double Bottom Line. (New York: Women’s World Banking Focus Note, 2008).

Ghosh, S. and E.V. Tassel. A Model of Mission Drift in Microfinance Institutions. (Department of Economics, Florida Atlantic University, 2008).

Iqbal, Z. (2014). “Enhancing Financial Inclusion through Islamic Finance”, paper presented at Financial Inclusion Conference, Turkey, 2014.

Iqbal, Z. and A. Mirakhor. “Financial Inclusion: Islamic Finance Perspective”, Journal of Islamic Business and Management, Vol 2(1), (2012): 35-64.

Iqbal, Z. and A. Mirakhor. “Islam’s Perspective on Financial Inclusion”, in Iqbal, Z. and A. Mirakhor (Eds.), Economic Development and Islamic Finance. (World Bank Publications: Washington DC, 2013): 179-200.

Leyshon, A. and N. Thrift. “Geographies of Financial Exclusion: Financial Abandonment in Britain and the United States”, Royal Geographical Society, (1995): 312-341.

Mohieldin, M., Z. Iqbal, A. Rostom, and X. Fu. “The Role of Islamic Finance in Enhancing Financial Inclusion in Organization of Islamic Cooperation (OIC) Countries”, Islamic Economic Studies, 20(2), (2012): 55-120.

Naceur, S.B. A. Barajas and A. Massara. “Can Islamic Banking Increase Financial Inclusion?”, IMF Working Paper, WP/15/31, (2015).

Saaty, T.L. Theory and Applications of the Analytic Network Process: Decision Making with Benefits, Opportunities, Costs and Risks, (RWS Publications: Pittsburgh, 2005)

Saaty, T.L and L.G. Vargas. Decision Making with the Analytic Network Process: Economic, Political, Social and Technological Applications with Benefits, Opportunities, Costs and Risks, (Springer Science + Business Media: New York, 2006).

Zeller, M. and R.L. Meyer. The Triangle of Microfinance: Financial Sustainability, Outreach and Impact, (The John Hopkins University Press: London, 2002).