By Gustav Boethius

Download Insight 34 Boethius HERE

This is the first in a series of four MEI Insights exploring the concept of demand security in the GCC. Having conceptualised demand security in the GCC context, the next three Insights will focus on the major factors that are likely to curb the demand for oil and gas imports from the Gulf region. The second Insight will highlight the implications of the renewable energy industries for the GCC’s demand security. Energy security continues to be a central topic in both Middle Eastern and international politics, and numerous articles and commentaries focus on the challenges facing the nations dependent on foreign energy imports. There is however a surprising dearth of material exploring the issue of oil and gas trade from the perspectives of the energy exporters. This article seeks to shed some light on the concept of demand security – an often overlooked aspect of the global energy security dynamic. It will highlight the importance of demand security for the Gulf Cooperation Council’s (GCC) member states, as well as looking at the current trends that challenge demand security in these countries. Reliable and affordable supplies of energy are today a key element of a national security arrangement. As domestic energy resources are increasingly being depleted, most industrialised nations have to look abroad to satisfy their energy needs, exposing themselves to significant levels of economic, political, and military risk. The role that energy security has played in recent history cannot be overstated. It was, for instance, a major aspect of the two world wars, during which securing one’s energy supplies and disrupting those of the enemy was a core wartime strategy. Energy was again securitized during the oil embargoes of the early 1970s when the modern concept of energy security made it on to the international policy agenda. It is therefore hardly surprising that energy security is often framed in terms of a consumer’s anxiety about energy supplies. This one-sided view of energy security, however, overlooks the fact that energy is a traded commodity and that trade is a two-way street. The mirror image, therefore, of a consumer’s energy security is that of the demand security of the producer. Today, demand security is perceived as an equally, if not more, pressing issue for energy exporting nations as energy security is to energy importing nations. As such, it plays a central role in their economic and foreign policies. Russia provides a potent exampleas it is making considerable efforts to maintain the demand for its gas in the European markets, as well as increase demand for its exports in Asia. Maintaining demand security is also a growing concern in the GCC, and is likely to play an increasing role in the decision-making processes of both its member states and in the organisation as a whole in the near future.

Motives for maintaining demand security in the GCC

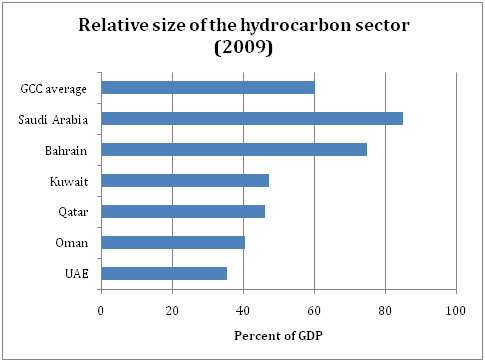

The member states of the GCC (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates) are all heavily dependent on revenues derived from their oil and gas exports. 85% of Saudi Arabia’s economy consists of oil and gas revenues and more than 60 percent of the GCC’s total GDP is today generated by the hydrocarbon sector (see Figure 1). When taking into account other sectors of the economies that depend on the oil and gas industries, these figures become significantly higher.

Figure 1. Sources: Central Bank of Bahrain, May 2011 Report; Central Bank of Kuwait, Annual Report 2010/2011; Central Bank of Oman, Annual Report 2010; Central Bank of Qatar, Annual Report 2009; Saudi Arabian Monetary Authority, 46th Annual Report; Central Bank of the UAE, Annual Report 2010; World Bank; The CIA World Factbook.

A high reliance on oil and gas exports results in a heavy fiscal dependence on the global energy market. This market is particularly volatile and this volatility exposes the GCC economies to high levels of risk. The diversification of the economies, therefore, is today one of the highest priorities of the GCC member states. Different policies to achieve this diversification have been in place for decades, with varying degrees of success. More time is needed, however, to achieve a satisfactory level of economic independence from the hydrocarbon industry. Maintaining the revenues from, and hence the demand for, energy exports buys these nations time to achieve these goals. Rapid population growthin the GCC member states also adds to the importance ofdemand security. The demographic composition of Middle Eastern countries have been widely cited among the underlying factors behind the ÔÇÿArab Spring’ and states across the region now have to provide for larger and younger populations, including those in the Gulf. Here, the provision of employment is one of the most pressing issues. Although the unemployment data for the region is as patchy as it is political, there is no doubt that there are not enough job opportunities for the increasing numbers of youths entering the job market. Diversifying the economy and meeting the demands of the people are interlinked challenges, the solution to which depends on the income generated from sales of oil and gas. Growing populations are also an increasing burden on the GCC member states’ welfare systems. The lack of taxation in the GCC member states is often cited as a condition that alters the traditional social contract between the state and its citizens, diminishing the state’s accountability towards the citizenry. No taxation no representation is a popular argument for the lack of democracy in the Gulf, where the government is given the role of distributing the wealth generated by state-owned oil and gas resources. However, should the rent derived from these resources diminish and force the state to default on providing the services its citizens expect, it is likely that the pressures for political reform will increase. The unrest in Bahrain, a GCC member state with low and diminishing revenues from hydrocarbon exports, provides an example of what could happen in the region as a whole if the demand for oil drops significantly.

Current threats to the Gulf’s demand security

There are currently a number of threats to the demand for Gulf oil and gas in both the medium and long term. These will ultimately result in the development of alternative, often green, technologies that compete with the Gulf’s oil and gas on the global energy market. Investmentin these technologies will increase their efficiency, durability and applicability and will increase their presence in markets traditionally dominated by the hydrocarbon industries. Concerns about what the continued reliance on imported energy means for consumer nations are one of the main drivers behind investment in alternative energy technologies. The first of these concerns pertains to the sheer cost of dependence on foreign energy supplies. The costs of energy imports are already massive – energy constitutes between 10 and 25 percent (depending on price levels) of the total value of global trade. Future political developments in the Middle East and their impact on production are also a major concern. The recent unrest in some of the GCC member states is the latest in a long line of events that highlight the dangers of relying on energy supplies from the region. In order to maintain demand security, the oil producing states must allay these fears. A further development with implications for the demand of theGCC’s energy exports is the international environmentalist movement.A growing awareness of the threat that climate change poses to international security has made a number of nations initiate a shift to emission-free technologies. Rising and unstable oil and gas prices are another major threat to the Gulf’s demand security. Rising prices will make alternative sources of energy, both non-GCC petroleum products and renewable energies, more competitive. Considerable efforts are being made on the part of the GCC states, and in particular Saudi Arabia, to stabilize the energy markets and to achieve favourable conditions for the region’s exports. The continuing demand for the GCC’s energy exports, one of its key security concerns, is far from secure. Growing demands for alternative sources of energy come at an inconvenient time for the countries in the Gulf and will impede their efforts to meet the demands of their citizens and to diversify their economies. The days of unsustainable rentierism are ending and the GCC member states will find themselves facing a series of difficult economic and political challenges in the not-too-distantfuture. Maintaining demand security will help these states to buy the time needed to adapt to a changing global energy landscape.

Gustav Boethius is a Researcher at the Middle East Institute. He is currently investigating the impact of the unrest in the Middle East on ASEAN’s energy security. Gustav holds an MSc in Strategic Studies from the S. Rajaratnam School of International Studies (RSIS) and an MSc in Chemical Physics from the University of Edinburgh. His research interests include the economic and foreign policies of the Gulf States and non-traditional security with an emphasis on energy security and climate change.