Series Introduction

The Covid-19 pandemic capped a series of events that made 2020 one of the most disruptive years in the annals of the energy industry, affecting markets, prices and livelihoods. The “Middle East, Asia and Energy Security in the Age of Covid-19” series of Insights looks at some of these developments and their impacts, including the astonishingly rapid emergence of the United States as the world’s leading oil and gas producer, the increasingly dire outlook for the member countries of the Gulf Cooperation Council, the role of Asia in resuscitating global oil and gas demand and the increasingly important role of China, among the world’s largest importers of oil and gas, in Middle East affairs

CLICK HERE FOR THE PDF

By Robin Mills

The Covid-19 pandemic of 2020 may have provided a window into the future for the Gulf region’s oil and gas exporters. The collapse in oil and gas prices and demand has accelerated the need for economic diversification and exposed the implications of a possibly imminent peak in world oil demand. Asia, the main global region for oil demand growth, is even more important for Gulf producers in these circumstances. Energy engagement between the two regions has deepened in recent years beyond trade into more investment flowing both ways. But awareness of climate policy and the geopolitical implications of the shifting Gulf–Asia relationship will be even more important in the near future.

The economies of the Gulf oil and gas exporters — the six Gulf Cooperation Council (GCC) member states (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates), Iran and Iraq — depend heavily on their hydrocarbon industries. The percentage of GDP that oil rents contribute to is about 40% for Kuwait and Iraq, 21–23% for Oman and Saudi Arabia, and 13–15% for the UAE, Qatar and Iran.[1]

However, the Gulf’s oil and gas exporters face three current challenges and one overriding future challenge. First, they have had to adapt over the past two decades to a steady shift in their markets from the United States, Europe and Japan to a growing dominance of emerging Asian markets, particularly China and India. This shift has required or at least encouraged the development of new marketing channels, customer relationships in upstream and downstream industries, and investments in overseas refining, along with the rising possibility of new China-centric pricing bases.

Second, since 2014, they have faced a sharp drop in oil and gas prices, mostly because of the enormously expanded production from US shale oil and gas basins. American hydrocarbons have increasingly become a competitor in Asian markets, while Gulf oil exports to the United States have diminished.

Third, the Covid-19 pandemic has led to a collapse in world oil demand and threatens future economic recovery. The brief Saudi–Russia price war of March 2020 has been followed by unprecedented deep production cuts by the so-called OPEC+[2] countries. Responses to Covid-19, such as more work-from-home arrangements, less air travel and “green” stimulus packages in the European Union, and possibly United States, also have generally negative implications for oil demand.

The future challenge these countries confront is that arising from climate change policies, particularly in the European Union. Climate change policies are likely to reduce fossil fuel demand and prices by encouraging energy efficiency and the adoption of non-fossil-fuel technologies such as electric vehicles, solar and wind power, biofuels and hydrogen.[3] Carbon border tariffs, proposed by the European Union for implementation in 2023,[4] would require the Gulf countries to impose carbon prices within their own economies or face higher costs for their carbon-intensive exports to the European Union (namely, oil, liquefied natural gas or LNG, steel, aluminium, fertilisers, cement and petrochemicals, all key to the Gulf economies). US climate policy may also tighten, given Joe Biden’s victory in the presidential election, although his administration’s ambitions in this regard will be constrained if the Republicans retain control of the Senate.[5] The combination of these policies with other technical advances, behavioural and demographic changes, and slower economic growth could lead to a peak in world oil demand in the relatively near future, a prospect that is of concern to OPEC.[6]

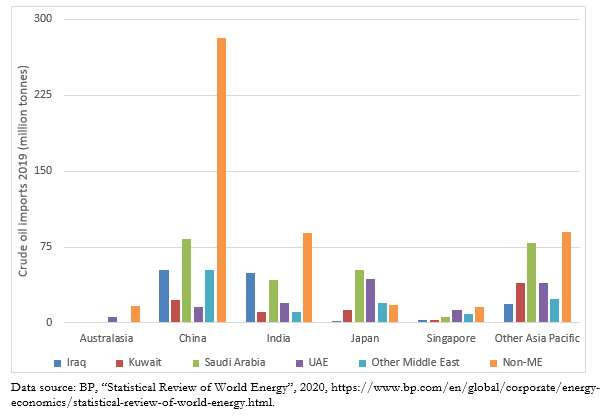

Despite the rise of US oil exports, Asia remains highly dependent on imports from the Middle East (see Figure 1). As Asian oil demand grows and its domestic oil production runs down, this dependency will deepen. Still, this dependency varies significantly between Japan, which gets 88% of its crude from the Middle East, and China, which gets 44% from the region. Conversely, the Gulf exporters are closely linked to their Asian customers: 98% of the UAE’s crude exports, 89% of Kuwait’s, 74% of Saudi Arabia’s and 62% of Iraq’s go to Asia.[7] Because of US sanctions, China is Iran’s virtually only paying customer for crude.

The Economic Challenge of “Peak Oil Demand”

Given the impact of Covid-19, OPEC estimated that oil demand in 2020 was 90.01 million barrels per day (b/d),[8] compared with 99.76 million b/d in 2019, and rising to just below 95.9 million b/d in 2021. BP’s energy outlook, released in September 2020, had three scenarios, in two of which peak oil demand is already behind us because of the economic impact of Covid-19, climate change and the expanding use of electric vehicles.[9] While 2019 will probably not turn out to have been the all-time peak in oil demand, nevertheless a peak date in the late 2020s to mid-2030s is supported by an increasing number of forecasts. The risk management and quality assurance consultancy DNV GL sees a plateau in demand until about 2030, while the International Energy Agency (IEA) forecasts a peak in the mid-2020s with a plateau to about 2030. Even before the pandemic, in late 2019, BP foresaw a peak in the mid-2030s and Goldman Sachs around 2024.

Figure 1. Asian Oil Imports by Country, 2019

These forecasts of “peak oil demand” are very different from the repeated and incorrect forecasts of “peak oil supply” made at least since Marion King Hubbert’s 1956 paper[10] to the present day. A belief in imminent peak oil supply is a bet against improving technology and the operations of the market; a prediction of near-term peak oil demand is a bet on improving non-oil technologies and/or the successful operation of policies against climate change.

While global climate change policy has so far fallen far short of what is required to reduce emissions, non-fossil technologies, such as solar and wind power and batteries, have improved dramatically in cost and performance in recent years to the point of outcompeting fossil fuels in an increasingly material range of applications.[11] This trend can be seen particularly in the Middle East, with purchase prices for solar photovoltaic power in the UAE and Saudi Arabia repeatedly reaching world-record lows. The EU’s commitments to cut emissions by 55% by 2030[12] and to be carbon-neutral by 2050, and China’s commitment to be carbon-neutral by 2060, may not be achieved but even substantial progress towards these goals would mean the replacement of much of the current transport fleet with zero-emission vehicles, whether powered by electricity, hydrogen, biofuels or other means.

There is, of course, substantial uncertainty about the timing of any peak in oil demand, the level of production at peak, the speed of drop-off afterwards,[13] and the prices that would accompany and follow a peak. Falling prices and constraints on production in many OECD countries (eg, outright bans on new fossil fuel extraction and increasing unwillingness of financiers to back coal, oil and gas production owing to environmental pressure) would likely leave the low-cost Gulf producers with rising market share, if they invest sufficiently in new production and do not continue aggressive attempts at price defence via production cuts under the OPEC+ framework. In this case, Gulf production could continue growing, but probably at significantly lower prices, leading to falling overall revenues.

The risks of anticipating an early peak which then does not materialise appear less than that of being taken by surprise by a peak. Preparations for peak demand include economic diversification, fiscal consolidation and targeting a steady rise in market share, all policies which the Gulf economies have been aspiring to, if not often achieving, for the past three decades and more.

Gulf–Asia Energy Relations

The pattern of Gulf–Asia energy engagement differs across countries, fuels and modes of engagement. At the simplest level, the Gulf countries, have, of course, been important suppliers of oil to Asia, particularly since the post-Second World War phase of Japanese growth. Their oil exports to Asia have been matched by their increasing imports of Asian manufactured goods and migrant labour. From the 1950s, Asian companies have made a growing number of equity investments in oil and gas production, LNG, and refining in the Middle East, beginning with Japanese companies,[14] then in the 2000s Chinese and other companies. More recently, the Gulf countries, particularly Saudi Arabia, have stepped up their outbound investment in refining and petrochemical projects in their Asian consumer countries.

Asian Investments in the Gulf Region

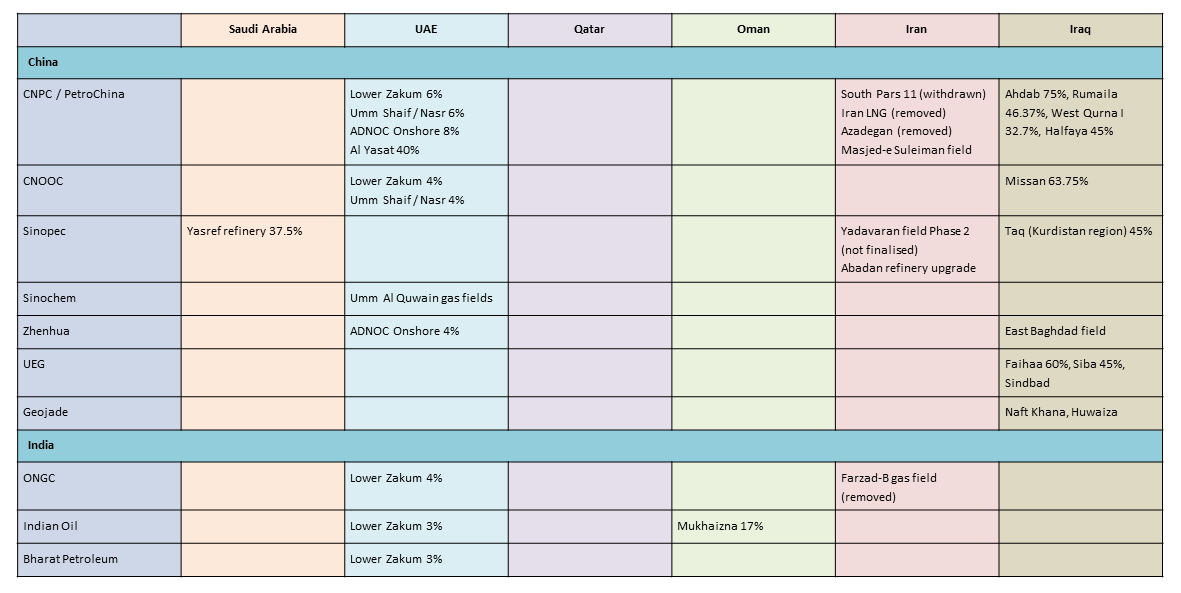

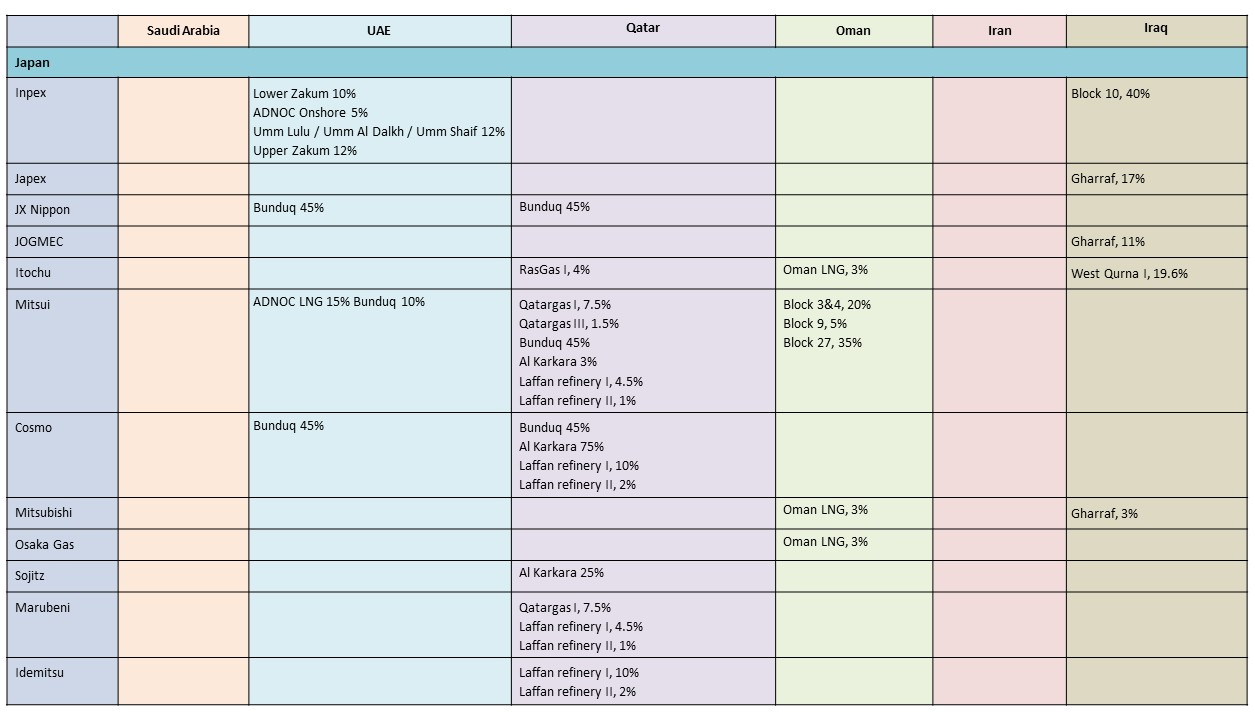

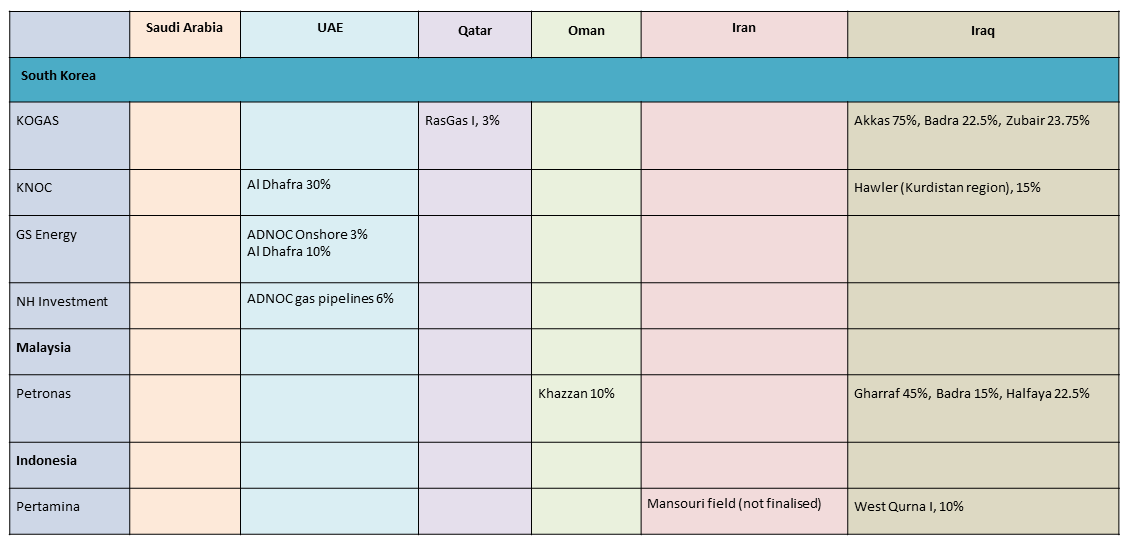

Upstream investments in Gulf energy by Asian firms are primarily concentrated in Iraq and the UAE, due to their openness to foreign companies and to the restructuring of their upstream contracts over the past decade, which opened up numerous opportunities. (See Table 1.) Negotiations for projects in Iran have mostly been unsuccessful because of US sanctions and unreasonable commercial expectations and bureaucratic hold-ups.

China is the largest investor in terms of the number and size of projects and range of countries covered. Its three large state oil firms, particularly CNPC/PetroChina, are well represented, while other state and private companies have increased their investments in recent years. Japan, with its long history in the Gulf, has a wide range of mostly smaller investments, including notable minority positions in LNG, fragmented across a range of former state firms and trading houses. Generally, although Asian firms have gained ground in recent years, they tend to hold minority and non-operated stakes while the major Western international oil companies still predominate, notably ExxonMobil, Total, BP, and ENI.

Asian companies have been important in providing finance for Gulf energy projects, including through export credit agencies. For instance, Korea Eximbank extended financing to the Akkas gas field in Iraq, operated by KOGAS, while the Japan Bank for International Cooperation has extended a number of loans to support Japanese firms in maintaining their stakes in Abu Dhabi’s oil fields.[15] The Japan International Cooperation Agency funded the rehabilitation of Iraq’s Basrah and Khor Al Amaya oil export terminals.

Financial struggles amid low oil prices and the hangover of Covid-19 in some Gulf countries, notably Iraq, Oman and Bahrain, could open the door for further Asian investment in the energy sector. Privatisation of Oman’s oil and gas assets is likely in the near term while in December 2019 China’s State Grid agreed to buy 49% of Oman Electricity Transmission. However, the initial public offering of 1.5% of Saudi Aramco did not attract much interest from Asian (or any international) investors.

Table 1. Selected Asian Equity Investments in Gulf Oil and Gas

Sources: Websites of respective oil and gas companies

Gulf Investments in Asia

Gulf companies, for their part, have been active in investing in the energy sector in Asia, primarily in refining and petrochemical joint ventures and oil storage. In particular, some have been pursuing the economic benefits of integrating large refining and petrochemical plants.

For the Gulf countries, investing in the energy sector in Asia is intended to give them security of demand in their large and growing markets. The petrochemical projects, in particular, are intended to offset the possibility of a peak in oil consumption for transport fuels. For the host countries, these projects bring some welcome investment into domestic fuel supply and the reassurance that they would not be subject to politically motivated supply interruptions as during the 1973–4 oil shock.

Among the national oil companies (NOCs), Saudi Aramco, the leading oil exporter, has been by far the biggest exponent of this strategy, having major refining assets in Japan, South Korea, China and Malaysia, and projects in India. Abu Dhabi’s ADNOC has partnered with Aramco for a planned refinery in India’s Maharashtra state, while its strategic investment company, Mubadala, has upstream interests in Southeast Asia and a stake in a refinery in Pakistan. Kuwait Foreign Petroleum Exploration Company (KUFPEC) has various projects across Southeast Asia, and Kuwait Petroleum recently completed the Nghi So’n joint venture refinery project in Vietnam.

However, the utility of this strategy for both sides is questionable. If the downstream investments are profitable investments in themselves, and can be facilitated by government-to-government links and long-term supply contracts, they can be attractive. However, they do expose a large quantity of Gulf capital to the oil sector, where Gulf governments are already overweight. In the event of serious security problems in the Gulf, overseas refineries will still need to find alternative supply, no matter who their owners are (oil storage facilities, in contrast, do offer improved energy security). Conversely, as oil demand declines in countries such as Japan (whose consumption peaked in 2003) and Taiwan (where the peak was reached in 2007), Gulf investors could be left with poorly sited refineries that have to compete in the cutthroat refined products export markets of Asia.

In line with these observations, it appeared by October 2020 that Saudi Aramco had shifted its strategy towards acquiring existing assets in India and China rather than building new ones. For instance, in China it deferred a US$10 billion refining and petrochemicals complex planned with the Chinese military conglomerate Norinco in northeastern China in favour of buying a stake in the Zhejiang refinery. In India, it took a 20% stake in the oil and chemicals business of the Indian conglomerate Reliance.[16]

The picture is rather different for LNG. Asia is highly under-gasified by world standards and still significantly dependent on coal. Switching from coal to gas offers significant greenhouse gas savings but has been held back in Asia by insufficient infrastructure, dominant utility companies and the low price of coal. In 2019, China’s primary energy demand was 58% coal and 8% gas; India’s 55% coal and 6% gas. This compares with the world average of 27% coal and 24% gas and with consumption in the United States, comprising 12% coal and 32% gas.[17] Gas is a key part of the strategies of China and India for improving air quality and reducing carbon emissions. Some Asian countries that are more gas-dependent, notably Bangladesh, Pakistan, Indonesia and Malaysia, are running short of domestic resources and have turned to LNG imports. With very few cross-border pipelines, Asian countries primarily rely on LNG imports (China is something of an exception, with pipelines from Russia, central Asia and Myanmar, but its 2019 imports were still 64% LNG and only 36% by pipeline).

Owing to a gross global oversupply of LNG as well as record-low prices, already in evidence in 2019 but exacerbated by the pandemic, Qatar, as the world’s largest LNG exporter, has a strong strategic rationale to promote the use of gas and to invest in the development of LNG importing infrastructure in Asia, particularly in countries with weaker technical and financial capacity. The recent formation of the new US$56 billion PipeChina company from the pipeline holdings of the three major state oil firms may ease access to transport for independent gas suppliers.[18] This in turn will increase the number of Chinese firms seeking to buy LNG from suppliers such as Qatar, and the total volumes committed.

With tightening climate policy, the key elements in the continuing use of the Gulf’s fossil fuel resources will be petrochemicals and petroleum-derived non-metallic materials; carbon capture, use and storage (CCUS); and novel decarbonised fuels such as hydrogen. The European Union is increasingly giving hydrogen a prominent place in its climate plans. Japan, in particular, has a hydrogen strategy focused on imports from low-cost producers, which could include Australia but also the Gulf. This is at a nascent stage, but the announcement on 7 July 2020 by the planned Saudi city of Neom for a US$5 billion “green” (renewable) hydrogen/ammonia production facility and the first shipment of “blue” ammonia (derived from fossil fuels with CCUS) from the Gulf to Japan, by Aramco in October 2020, could be signs of progress on this front. The Japanese, German, French and American firms that have shown interest in hydrogen so far are likely to be joined by others, including Chinese firms, bringing new low-carbon technologies. This is not simply about locating production facilities in the Gulf; it demands the creation of a whole network of conversion, transport and end-use, accompanied by new markets and contractual relationships. The emergence of hydrogen as a major new business will require initial government support and strong commitment from state-owned as well as large private companies, on both the side of Gulf hydrogen producers and Asian users.

With the Gulf’s rapidly gaining solar sector, there is also enormous scope for renewable energy investment, financing and equipment sales in the Gulf, already evidenced by several Chinese projects. A more detailed discussion is beyond the scope of this paper.

Conclusions

The Covid-19 pandemic has made it more urgent for the Gulf countries to undertake economic diversification and fiscal consolidation. It has not substantially changed the role of Asia as the key market for Gulf hydrocarbons. Indeed, it may even accelerate Asia’s role if Europe and the United States turn to strong “green stimulus” measures, further reducing their need for Gulf oil and gas.

But the Gulf countries are not passive actors. Indeed, Saudi Arabia, the UAE, Iran and Qatar in particular have all adopted increasingly proactive diplomatic, military, trade and economic policies in recent years, both within the Middle East and in their relations with the United States, China, India, Russia and other powerful states. While remaining broadly Western-aligned, the GCC states have cooperated with China on oil and gas and downstream industries although this could become more difficult as Washington demands that its partners implement some decoupling from China.

The threat posed by climate policy and improving non-oil technologies to the viability of the Gulf’s hydrocarbon resources is a growing concern for the region. Imminent peak oil demand or at least a substantial slowdown in demand growth, accompanied by low prices, are realistic prospects. The Gulf’s more far-sighted states have been formulating climate-resilient policies, but there are no easy answers to this concern, nor to the long-standing challenge of economic diversification.[19] Gaining oil market share from high-cost producers offers some medium-term protection to Gulf NOCs but they have to invest very selectively in Asian downstream projects, avoiding locking up too much capital in stranded assets. Eventually, they would need to leverage their natural resources — low-cost hydrocarbons, geological carbon dioxide storage, sun and land — with their acquired energy skills and relationships to produce decarbonised products compatible with a carbon-neutral world after mid-century.

The urgency of the Covid-19 crisis may hasten some long-needed reforms. At the same time, it offers opportunities for proactive Asian countries to deepen their relationships with their key energy suppliers. But the highly fragmented interests on both sides mean this will not be a tidy or uncontested process.

About the Author

Robin M Mills is CEO of Qamar Energy, a Dubai-based energy consultancy, and author of The Myth of the Oil Crisis.

Image caption: An oil refinery at dusk. Photo: Piqsels

End Notes

[1] World Bank, Oil rents (as a percentage of GDP), nd, https://data.worldbank.org/indicator/NY.GDP.PETR.RT.ZS?most_recent_value_desc=true.

[2] OPEC, the Organisation of the Petroleum Exporting Countries, is an intergovernmental body for coordinating the petroleum policies of member countries, who include most of the GCC countries and Iran and Iraq. In December 2016, several other petroleum exporting countries reached a deal on production limits with OPEC. These countries have since been dubbed the OPEC+.

[3] Hydrogen can be made from fossil fuels (“grey hydrogen” or, if carbon capture and storage is used, “blue hydrogen”) or by the electrolysis of water; if electrolysis is performed with renewable electricity, the product is referred to as “green hydrogen”.

[4] Sam Lowe, “EU Border Carbon Adjustments: Proposed Models and the State of Play”, Centre for European Reform, 8 July 2020, https://www.cer.eu/in-the-press/eu-border-carbon-adjustment-proposed-models-and-state-play.

[5] “Biden’s big election shake-up”, Petroleum Economist, 28 July 2020, https://www.petroleum-economist.com/articles/politics-economics/north-america/2020/biden-s-big-election-shake-up.

[6] Alex Lawler, “End game for oil? OPEC prepares for an age of dwindling demand”, Reuters, 28 July 2020, https://www.reuters.com/article/us-global-oil-demand-insight/end-game-for-oil-opec-prepares-for-an-age-of-dwindling-demand-idUSKCN24T0KT?utm_medium=Social&utm_source=twitter.

[7] BP, “Statistical Review of World Energy”, 2020, https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

[8] OPEC, “OPEC Monthly Oil Report January 2021”, 2021, https://momr.opec.org/pdf-download/.

[9] BP, “BP Energy Outlook”, 2020, https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html.

[10] Marion King Hubbert, “Nuclear Energy and the Fossil Fuels”, American Petroleum Institute, March 1956, http://www.energycrisis.com/Hubbert/1956/1956.pdf.

[11] For example, see A Tsakalidis, J Krause, A Julea, E Peduzzi, E Pisoni and C Thiel, “Electric light commercial vehicles: Are they the sleeping giant of electromobility?” Transportation Research, 2020 doi:10.1016/j.trd.2020.102421, for light commercial vehicles; Dolf Gielen, Francisco Boshell, Deger Saygin, Morgan D Bazilian, Nicholas Wagner and Ricardo Gorini, “The Role of Renewable Energy in the Global Energy Transformation”, Energy Strategy Reviews 24 (2019): 38–50, doi:https://doi.org/10.1016/j.esr.2019.01.006, for renewable.

[12] European Commission, “State of the Union: Q&A on the 2030 Climate Target Plan”, 17 September 2020, https://ec.europa.eu/commission/presscorner/detail/en/QANDA_20_1598.

[13] For a more detailed discussion of these points, see Spencer Dale and Bassam Fattouh, “Peak Oil Demand and Long-Run Oil Prices”, Oxford Institute for Energy Studies, 2018, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2018/01/Peak-Oil-Demand-and-Long-Run-Oil-Prices-Insight-25.pdf.

[14] Loftur Thorarinsson, “A Review of the Evolution of the Japanese Oil Industry, Oil Policy and its Relationship with the Middle East”, Oxford Institute for Energy Studies, February 2018, 47, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2018/02/A-Review-of-the-Evolution-of-the-Japanese-Oil-Industry-Oil-Policy-and-its-Relationship-with-the-Middle-East-WPM-76.pdf.

[15] Japan Bank for International Coperation, “JBIC Signs Facility Agreement with ADNOC”, 16 January 2018, https://www.jbic.go.jp/en/information/press/press-2017/0116-010442.html.

[16] Rania El Gamal, Davide Barbuscia and Marwa Rashad, “Sole survivor? Saudi Aramco doubles down on oil to outlast rivals”, Reuters, 7 October 2020, https://uk.mobile.reuters.com/article/amp/idUSKBN26R3PA.

[17] Figures from BP, “BP Statistical Review of World Energy”, 2020, https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

[18] Bloomberg, “Why China’s putting all its oil pipes in one company”, Washington Post, 27 July 2020, https://www.washingtonpost.com/business/energy/why-chinas-putting-all-its-oil-pipes-in-one-company/2020/07/24/3b17e07e-cd62-11ea-99b0-8426e26d203b_story.html.

[19] Steffen Hertog, “What would the Saudi economy have to look like to be ‘post rentier’?” POMEPS Studies, 2019, 29–33, http://eprints.lse.ac.uk/101386/1/Hertog_what_would_the_saudi_economy_have_to_look_like_to_be_post_rentier_published.pdf.