In the past years many things have changed in the Gulf region. Economic growth has slowed down, new leaders have taken power and security in the region has deteriorated. Against this background, the aim of the Saudi Arabia series of papers is to provide a comprehensive, interdisciplinary understanding of how the kingdom is responding and adapting to the new reality. The papers cover different aspects of Saudi Arabia, such as its economic transformation, the energy market, relations with the United States, Europe and East Asia, external security threats and the role of the youth, women and religion in society.

This paper analyses how the development of an alternative energy strategy can help Saudi Arabia pursue the goals outlined in its Vision 2030. First, it presents the rationale for energy source diversification and applies the logic to Saudi Arabia and its particular conditions. Next, it examines the steps Saudi Arabia has taken to develop nuclear, solar and wind power capacity. The paper concludes that developing alternative energy sources for domestic consumption will not only contribute to diversifying and strengthening the Saudi economy but will also enable the kingdom to continue enjoying the economic returns and international influence arising from its role as a major oil exporter. In addition, it will help profile the kingdom as a success story in sustainability.

CLICK HERE FOR THE PDF.

By Mattia Tomba and Sara Corradini

In April 2016, Crown Prince Mohammed bin Salman of Saudi Arabia launched Vision 2030, a blueprint aimed at ensuring a successful future for the country by focusing on specific goals such as broadening the country’s economic base, unlocking business opportunities, creating jobs for all Saudis, providing a sustainable living environment, and enhancing the population’s physical well-being.[1] As part of Vision 2030, the kingdom aims to reduce its carbon emissions and create a renewable energy capacity of 27.3GW by 2024 and 58.7GW by 2030 while also remaining a major producer of hydrocarbons.[2] This paper analyses the role that alternative energy, identified as renewables and nuclear energy, can play in achieving the kingdom’s goals.

Why Oil Producers Seek Alternative Energy Sources?

Increasing renewable energy capacity involves developing massive infrastructure projects, which in turn requires significant public resources. Therefore, it is important to understand the benefits and implications of such projects. In particular, there are four dimensions that oil- and gas-producing countries need to consider.[3]

First, countries that derive their income mainly from the export of fossil fuels but whose domestic energy needs also depend heavily on these fuels must understand the economic and financial gains arising from switching to alternative energy sources. In fact, by using renewables and nuclear energy to meet domestic demand, they can increase their export capacity and thereby obtain higher revenues.

Second, exporting oil and gas has geopolitical implications, given the role the two commodities still play in the global energy market: possessing large quantities of oil and gas for export enhances a country’s foreign influence, and having spare capacity allows it to control prices.

Third, countries should determine the number of jobs that can be created through the renewables and nuclear industries as well as the kinds of new occupational roles needed, variables that depend on the conditions of the domestic labour market and the level of automation. Since jobs related to construction, operations and maintenance in countries like Saudi Arabia are usually filled by workers from South Asia, it is important to understand whether new jobs will also increase opportunities for the domestic workforce.

Finally, while the primary aim behind developing the renewables and nuclear energy industries is to diversify energy sources, doing so will also have an impact on the level of carbon emissions. This is an important consideration as energy-related pollution is high in the Arabian peninsula.

The Case of Saudi Arabia

Several unique conditions make the development of renewable energy highly feasible for Saudi Arabia. To begin with, the country is among the largest oil consumers globally, but it also enjoys good sunshine and wind conditions. At the same time, the demand for electricity is high and increasing, both domestically and regionally. Strong regional demand could translate into business potential as Saudi Arabia can sell electricity to neighbouring countries through the Gulf Cooperation Council (GCC) interconnector, a power transmission grid connecting the GCC countries, as well as to East Africa. Additionally, Saudi Arabia benefits from its strategic location in the Middle East, which makes it a potential hub for renewable technologies, and it possesses solid financial means to develop renewables, thanks to past revenues from sales of fossil fuels.[4] However, the country faces difficulty in attracting foreign businesses to invest in domestic industries that will help it achieve its sustainability goals. The kingdom also suffers from a high unemployment rate, amounting to 12 per cent of Saudi nationals in 2019 and is experiencing economic uncertainty brought about by fluctuating oil prices.[5] This was most recently demonstrated by the price war with Russia caused by the fall in global energy demand in the wake of the Covid-19 pandemic.

Given these considerations, how does the logic of energy diversification apply to Saudi Arabia?

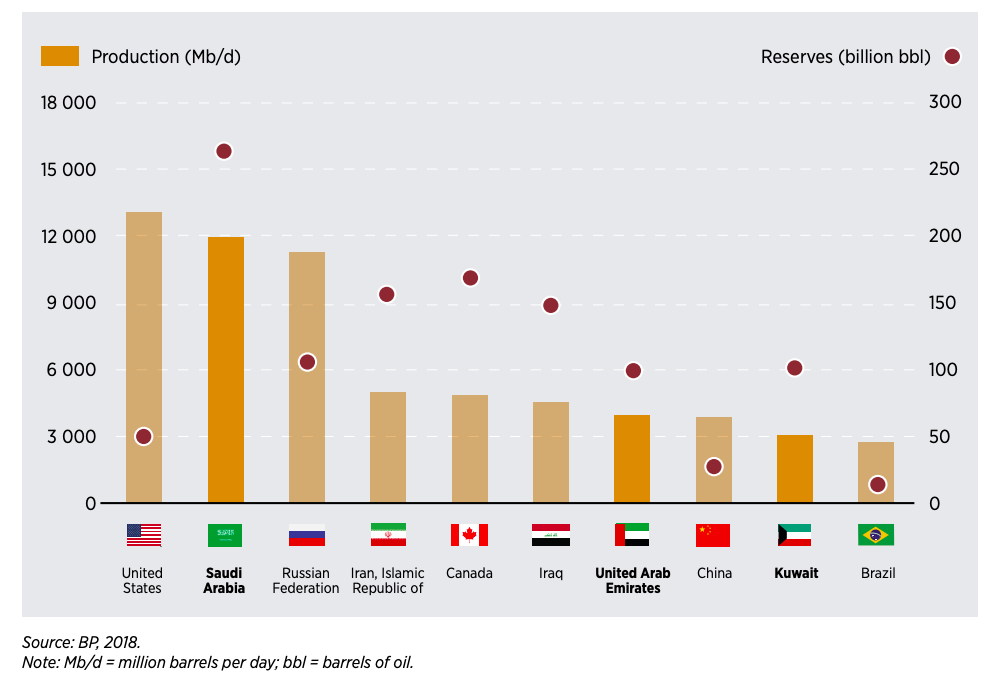

The first point to note is that oil revenue is susceptible to price and cost fluctuations, and switching to alternative energy sources will serve as a hedge against such fluctuations. Being the second largest oil producer in the world (Figure 1), the kingdom benefits from low oil production costs, which means that sudden disruptions in demand are less crippling than for countries whose oil production costs are higher, like Canada or Venezuela.[6] On the other hand, low (or negative) oil prices can drive down revenue sharply, making it financially unsustainable to depend excessively on this source of income and weakening its resilience against sudden but lasting disruptions. Therefore, while hedging against fluctuations in oil revenues by developing alternative energy sources may not be as fundamental a variable for Saudi Arabia as it is for other oil producers, it is still important for longer-term strategic calculations.

Figure 1: World’s Largest Countries in Terms of Oil Production and Reserves

Source: “Renewable Energy Market Analysis: GCC 2019”, International Renewable Energy Agency (IRENA), January 2019, https://www.irena.org/publications/2019/Jan/Renewable-Energy-Market-Analysis-GCC-2019#:~:text=January%202019&text=This%20report%20from%20the%20International,2030%20Agenda%20for%20Sustainable%20Development.

The second point relates to job creation. Whereas automation may diminish the number of opportunities related to the alternative energy industry in the long run,[7] there is nevertheless the potential to increase the availability of new jobs and produce a more skilled workforce in the immediate future. In addition, Saudi Arabia will gain by attracting new businesses linked to the energy supply value chain.

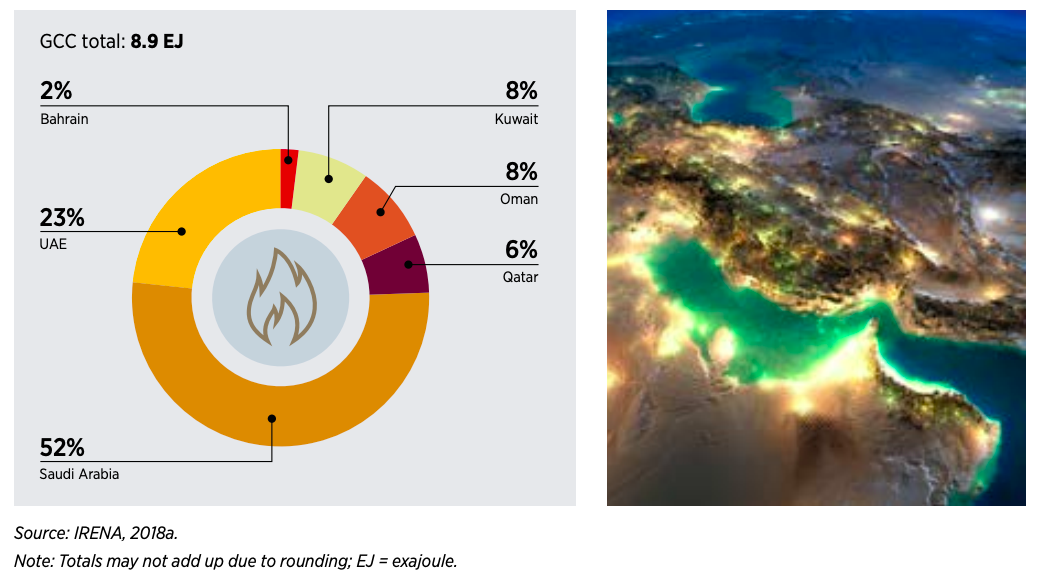

The last point relates to the potential for revenue maximisation. It should suffice to point out that, in 2018, Saudi domestic oil consumption amounted to more than three million barrels of oil, a quantity expected to increase to eight million by 2050, partly as a consequence of population growth.[8] According to the International Renewable Energy Agency (Irena), Saudi Arabia is already the world’s sixth largest oil consumer and the biggest among GCC countries. (Figure 2).[9] Using renewable and nuclear energy for domestic needs will reduce the domestic consumption of fossil fuels, which in turn will allow Saudi Arabia to continue exporting them — and enjoying the geopolitical influence that follows.

Figure 2: Energy Consumption in the GCC Countries in 2016

Source: “Renewable Energy Market Analysis: GCC 2019”.

Thus, producing energy in alternative ways will allow the country to meet domestic demand and at the same time increase its capability to sell oil abroad. This, in turn, will strengthen the economy through the diversification of revenue sources and nurturing of a skilled workforce and enhance the kingdom’s attractiveness to foreign businesses and investors. These potentials become even more enticing considering that research from McKinsey and Company shows that renewables will account for more than 50 per cent of generated power in the world after 2035.[10]

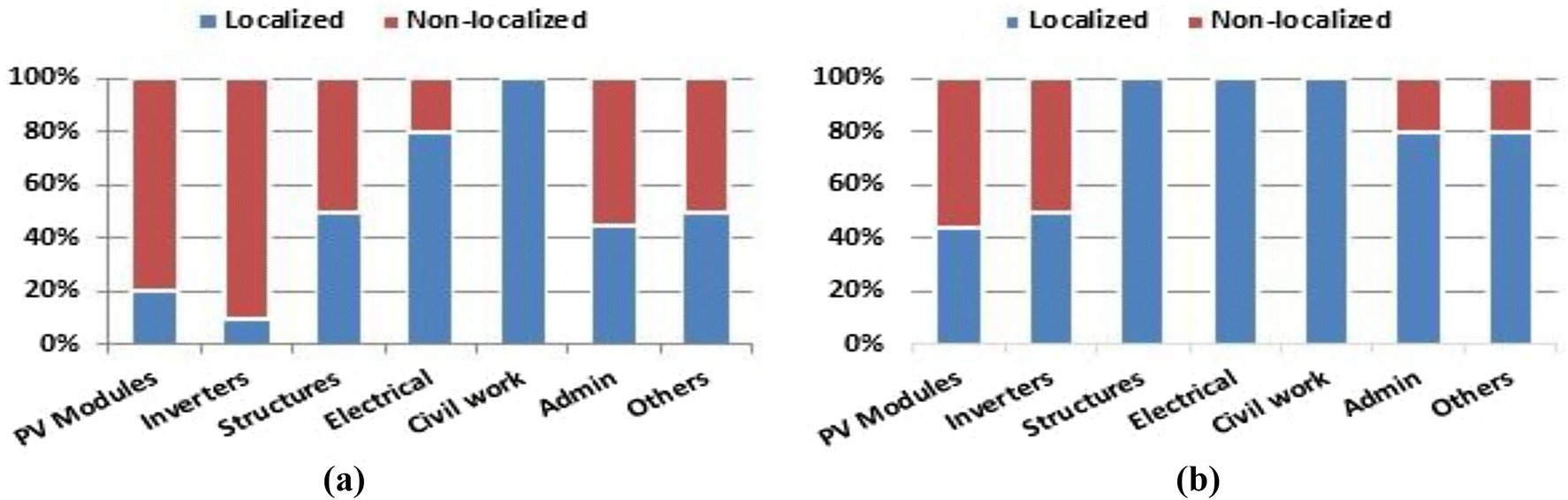

One relevant example is Saudi Arabia’s National Renewable Energy Program (NREP), which aims to address the aforesaid considerations by developing a local industry for renewables-related technologies. By investing in the domestic production of equipment for the renewables industry, and integrating the supply chains vertically, Saudi Arabia can in fact gain control of the whole value chain, thereby creating new opportunities for its labour force and local investors.[11] (See Figure 3) The NREP is therefore a strategic first step to reduce unemployment and attract investment.

Figure 3: (a) Supply of Components in the Solar Photovoltaic (PV) Value Chain as of 2018 and (b) Projected Supply in 2023

Source: Zaid S AlOtaibi, Hussam I Khonkar, Ahmed O AlAmoudi, Saad H Alqahtani, “Current Status and Future Perspectives for Localizing the Solar Photovoltaic Industry in the Kingdom of Saudi Arabia”, Energy Transitions 4, no.1 (2020), 6–7, https://doi.org/10.1007/s41825-019-00020-y.

On the other hand, challenges arise in accessing the required technological expertise and skilled manpower, as well as in being able to keep manufacturing costs competitive. To solve these issues, the kingdom is cooperating with other states to develop a number of solar, wind and nuclear projects, since pooling assets and knowledge fosters learning through observation and practice. Furthermore, Saudi Arabia’s main funding vehicle, the Public Investment Fund (PIF), is expanding its international presence in the field, as seen in its recent investments in companies such as Total, Eni and Royal Dutch Shell.[12] These companies, traditionally identified with the oil industry, have recently taken steps to re-invent themselves as “energy companies”[13] and can therefore provide lessons in terms of the kind of strategies and activities to adopt or avoid.

Interestingly, PIF owns 23 per cent of ACWA Power, a Saudi company involved in the development of power and desalination plants and which plans to invest 70 per cent of its portfolio in renewables by 2030.[14] Considering that Saudi Arabia registered an average yearly carbon emissions increase of 4.7 per cent between 2007 and 2017,[15] such investments will not only be beneficial for the economy but will also help decrease the kingdom’s carbon footprint and improve the quality of life. These outcomes are linked to achieving the kingdom’s Vision 2030 as well as the United Nations Sustainable Development Goals.

Nuclear Energy

Saudi Arabia aims to develop both large and modular nuclear reactors: the former will provide the country with 17GW of electrical capacity by 2040, while the latter will be used for desalinating water and producing heat.[16] Although Saudi Arabia possesses the world’s largest network of desalination plants, as of 2018, these were powered mostly by oil, with daily consumption amounting in that year to about 500,000 barrels.[17] Indeed, 40–50 per cent of the costs of desalination are due to energy.[18] Given this consideration and the fact that the production of desalinated water is estimated to increase by up to 14 times by 2040,[19] it is easy to see the potential benefits that using modular reactors can bring.

However, while nuclear power plants are beneficial to increasing energy independence and decreasing carbon emissions, they also bear more problems compared to renewables. Specifically, the catastrophic effects linked to nuclear accidents and nuclear terrorism cannot be taken lightly; additionally, in the Middle East, the development of nuclear capabilities must be considered in the context of historical rivalries, such as the one between Iran on one side and the United Arab Emirates (UAE) and Saudi Arabia on the other. This is probably the main reason why the kingdom has thus far been cooperating in a number of nuclear projects with countries such as France, Japan, China, Finland and South Korea,[20] but not with the United States. Even though talks with the latter are ongoing, Washington’s condition for cooperation is that Riyadh sign the so-called “123 Agreement”, which requires that third countries renounce the right to enrich uranium or reprocess spent fuel before US companies can participate in their nuclear energy projects.[21] This condition and the fact that renewables represent a cheaper source of energy are two reasons behind the slowdown in Saudi Arabia’s nuclear energy development plans. Nevertheless, geopolitical factors could affect Saudi Arabia’s future decision on the matter: in addition to its rivalry with Iran, which already has an ongoing nuclear programme, the other regional power, the UAE, recently became the first operator of peaceful nuclear energy in the Arab world.[22] Hence, it is likely that Saudi Arabia will continue to develop its nuclear programme, both as part of its established energy goals and as a means of enhancing its regional prestige and bargaining power.

Solar Energy

In January 2020, Saudi Arabia launched the third phase of its plan to diversify energy sources, aimed at adding a total of 1.2GW of solar photovoltaic (PV) capacity to the grid. This is another step towards one of the goals of Vision 2030, which is to ensure that by 2030 solar photovoltaics (PV) will provide 40GW of energy and concentrated solar power (CSP) an additional 2.7GW.[23] One area where the use of solar power has strategic significance is in the desalination of water through reverse-osmosis, a process that is currently powered by fossil fuels.[24] Switching to solar power for reverse-osmosis desalination will benefit both industries and households in terms of lowering the cost of water.

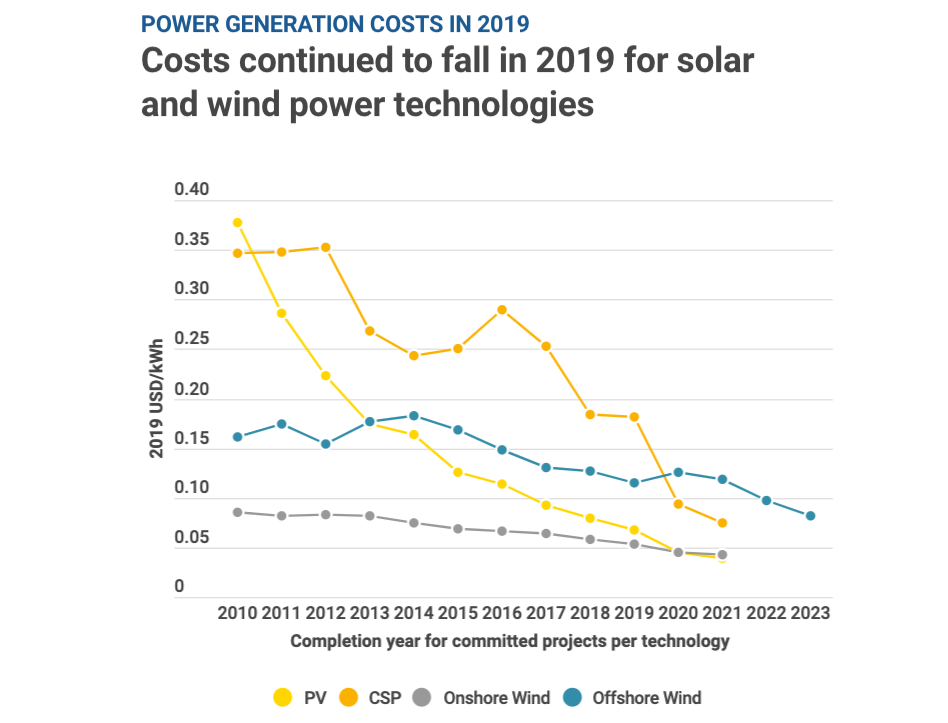

Among households, it is worth noting that while only an average of 1.60 per cent used solar power for their energy needs in 2019, more than 50 per cent said they would be willing to adopt this technology.[25] The number of interested users, coupled with the high solar radiation from which the kingdom benefits, increases the potential for significant growth in the solar industry. This forecast is reinforced by important cost considerations, particularly the fact that the global weighted-average levelised cost of electricity (LCOE)[26] for PV cells and CSP declined considerably (82 per cent and 47 per cent respectively) in the 2010–2019 period.[27] (See Figure 4)

Figure 4: Declining Global Costs of Renewable Energy Technologies

Source: “How falling costs make renewables a cost-effective investment”, IRENA, 2 June 2020, https://www.irena.org/newsroom/articles/2020/Jun/How-Falling-Costs-Make-Renewables-a-Cost-effective-Investment

In addition to energy savings effects, solar power generation is likely to increase the availability of domestic jobs because the kingdom’s future position as a major market player is expected to lead to localisation of production.[28] Provided such localisation includes the Saudi workforce, it represents one more way to diversify the economy while increasing opportunities for the Saudi population.

Wind Power

Similar to the case of solar energy, there are potential benefits that Saudi Arabia can reap through the use of wind power. While the objective of Vision 2030 is to derive 16GW of the kingdom’s clean energy from wind power,[29] a report by Irena states that harnessing wind power from just one per cent of suitable areas in Oman, Kuwait and Saudi Arabia could produce up to 26GW of capacity.[30] As a consequence of ongoing plans, it is further estimated that by 2028 more than half the new wind capacity in the region will be generated by the kingdom, which will also become the biggest market for wind power.[31]

In this context, a project that stands out for its size involves cooperation with France and the UAE to build an onshore wind farm in Dumat Al Jandal city from 2021.[32] In addition to being the Middle East’s biggest wind-power project, the Dumat Al Jandal farm is expected to set a record low in terms of LCOE, which experts note has already decreased from an initial cost of 2.13 US cents/kWh to 1.99 cents/kWh.[33] Lowered costs and higher efficiency of production will benefit the kingdom’s economy directly and also create positive spillovers for other countries interested in wind power as a source of energy. This in turn will enhance the kingdom’s international standing by making it a success story and an example to follow.

Conclusion

There is great potential for the development of renewables and nuclear energy in Saudi Arabia, one of the goals of Vision 2030. Developing alternative energy sources can bring advantages at both the domestic and international levels: at home, it will help the Saudi economy diversify and remain strong in spite of the decreasing revenue potential of fossil fuels; internationally, it will help the kingdom profile itself as a country actively working towards building an economy where success and sustainability not only co-exist, but also reinforce one other.

About the Authors

Mr Mattia Tomba is head of Asia-Pacific at Tradeteq, an electronic trading platform for institutional investors in trade finance. He is also an adjunct senior research fellow at the Middle East Institute, National University of Singapore. Mr Tomba has worked with Qatar’s sovereign wealth fund (Qatari Diar), where he managed an equity portfolio and handled large private equity and real estate transactions worldwide. He began his career with Merrill Lynch and was later with the Goldman Sachs Group. Mr Tomba graduated from the Fletcher School at Tufts University (Boston) with an MA in international affairs and currently sits on the Advisory Council of the school’s Center for Sovereign Wealth and Global Capital. He also has a BS in Business Administration from Bocconi University (Milan)/Sciences Po (Paris).

Ms Sara Corradini holds a double master’s degree in international politics and East Asia (University of Warwick, UK) and strategic studies (S Rajaratnam School of International Studies, Nanyang Technological University, Singapore). She received her bachelor’s in international economics, management and finance from Bocconi University, Italy. Passionate about political and security affairs, she has conducted extensive research on the international relations of the Indo–Pacific region, with a focus on Northeast Asia and particularly Japan. She speaks Italian, English, French and Japanese.

Image caption: Saudi Arabia and Solar Energy. Photo: Martin Prochnik / Flickr

Footnotes

[1] “Vision 2030”, Kingdom of Saudi Arabia, https://vision2030.gov.sa/en.

[2] “National Industrial Development and Logistics Programme”, Vision 2030, Kingdom of Saudi Arabia, https://vision2030.gov.sa/sites/default/files/attachments/NIDLP%20Delivery%20Plan%20-%20English%20Jan%202019.pdf; and MEED.com, “Riyadh Form Renewable Energy Body”, Power-Technology.com, 9 April 2020, https://www.power-technology.com/comment/saudi-arabia-renewable-energy-programmes/.

[3] Juergen Braunstein, “Green Ambitions, Brown Realities: Making Sense of Renewable Investment Strategies in the Gulf”, Belfer Center for Science and International Affairs, January 2020, 6–7.

[4] “Rating Action: Moody’s changes the outlook on Saudi Arabia’s rating to negative, affirms A1 rating”, Moody’s Investor Service, 1 May 2020, https://www.moodys.com/research/Moodys-changes-the-outlook-on-Saudi-Arabias-rating-to-negative–PR_423521.

[5] “Unemployment Rate”, Saudi Arabia General Authority for Statistics, https://www.stats.gov.sa/en/820.

[6] Juergen Braunstein, “Green Ambitions, Brown Realities”, 42–43.

[7] Juergen Braunstein, “Green Ambitions: Brown Realities”, 32–37.

[8] Mohammed Al Yousif, “Renewable Energy Challenges and Opportunities in the Kingdom of Saudi Arabia”, Saudi Arabia Monetary Authority, SAMA WP/19/08, November 2019, 3.

[9] “Renewable Energy Market Analysis: GCC 2019”, Irena, January 2019, 39–40, https://www.irena.org/publications/2019/Jan/Renewable-Energy-Market-Analysis-GCC-2019#:~:text=January%202019&text=This%20report%20from%20the%20International,2030%20Agenda%20for%20Sustainable%20Development.

[10] “Global Energy Perspective 2019”, McKinsey & Company, https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-energy-perspective-2019.

[11] Zaid S AlOtaibi, Hussam I Khonkar, Ahmed O AlAmoudi, Saad H Alqahtani, “Current Status and Future Perspectives for Localizing the Solar Photovoltaic Industry in the Kingdom of Saudi Arabia”, Energy Transitions 4, no.1 (2020), 6–7, https://doi.org/10.1007/s41825-019-00020-y.

[12] Andrew England and Simeon Kerr, “Cash-rich Gulf funds hunt for bargains as asset prices plunge”, Financial Times, 16 April 2020, https://www.ft.com/content/3facc407-200f-4e7c-9914-79b4baece119.

[13] Matthias J Pickl, “The Renewable Energy Strategies of Oil Majors — From Oil to Energy?”, Energy Strategy Reviews 26 (2019), 1–6.

[14] Stanley Carvalho, “Saudi Arabia’s ACWA Power to focus more on renewable energy projects: CEO”, Reuters, 9 September 2019, https://www.reuters.com/article/us-energy-wec-acwa/saudi-arabias-acwa-power-to-focus-more-on-renewable-energy-projects-ceo-idUSKCN1VU16E.

[15] Juergen Braunstein and Oliver McPherson-Smith, “Saudi Arabia’s Moment in the Sun”, Carnegie Endowment for International Peace, 7 May 2019, https://carnegieendowment.org/sada/79079.

[16] Névine Schepers, “Q&A: Understanding Saudi Arabia’s Nuclear Energy Programme”, International Institute for Strategic Studies, 30 April 2019, https://www.iiss.org/blogs/analysis/2019/04/saudi-arabia-nuclear-energy-programme.

[17] Lucas Laursen, “Saudi Arabia pushes to use solar power for desalination plants”, IEEE Spectrum, 20 April 2018, https://spectrum.ieee.org/green-tech/solar/saudi-arabia-pushes-to-use-solar-power-for-desalination-plants; Mohammed Al Yousif, “Renewable Energy Challenges and Opportunities”, 3.

[18] Lucas Laursen, “Saudi Arabia pushes to use solar power”.

[19] Molly Walton, “Desalinated water affects the energy equation in the Middle East”, International Energy Agency, 21 January 2019, https://www.iea.org/commentaries/desalinated-water-affects-the-energy-equation-in-the-middle-east.

[20] “Nuclear Power in Saudi Arabia”, World Nuclear Association, April 2019, https://www.world-nuclear.org/information-library/country-profiles/countries-o-s/saudi-arabia.aspx.

[21] MEED, “US confirms Saudi Arabia nuclear energy talks”, Power-Technology.com, 11 November 2019, https://www.power-technology.com/comment/us-confirms-saudi-arabia-nuclear-energy-talks/.

[22] Ashfaq Ahmed, “UAE becomes the first peaceful nuclear energy operating nation in the Arab world”, Gulf News, 3 March 2020, https://gulfnews.com/uae/uae-becomes-the-first-peaceful-nuclear-energy-operating-nation-in-the-arab-world-1.70123175.

[23] Jennifer Gnana, “Saudi Arabia launches third renewables round as it looks to diversify power mix”, The National, 9 January 2020, https://www.thenational.ae/business/energy/saudi-arabia-launches-third-renewables-round-as-it-looks-to-diversify-power-mix-1.962220.

[24] Molly Walton, “Desalinated water affects the energy equation”; and Lucas Laursen, “Saudi Arabia pushes to use solar power”.

[25] “Indicators of Renewable Energy in Saudi Arabia 2018”, General Authority for Statistics, 2018, 30–31.

[26] The US Department of Energy defines LCOE as “the average revenue per unit of electricity generated that would be required to recover the costs of building and operating a generating plant during an assumed financial life and duty cycle”. US Department of Energy, “Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2020”, February 2020, https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf.

[27] “Renewable Power Generation Costs in 2019”, Irena, June 2020, 12, https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019; and “How falling costs make renewables a cost-effective investment”, IRENA, 2 June 2020, https://www.irena.org/newsroom/articles/2020/Jun/How-Falling-Costs-Make-Renewables-a-Cost-effective-Investment.

[28] Zaid S AlOtaibi, Hussam I Khonkar, Ahmed O AlAmoudi, et al. “Current Status and Future Perspectives for Localizing the Solar Photovoltaic Industry in the Kingdom of Saudi Arabia”, 1–9.

[29] Jennifer Gnana, “Saudi Arabia launches third renewables round”.

[30] “Renewable Energy Market Analysis: GCC 2019”, 34.

[31] Jennifer Gnana, “Saudi Arabia launches third renewables round”.

[32] Anthony Di Paola, “Oil giant Saudi Arabia set to build first wind-power plant”, Bloomberg, 22 July 2019, https://www.bloomberg.com/news/articles/2019-07-22/oil-giant-saudi-arabia-is-set-to-start-first-wind-power-plant.

[33] “Saudi project may set the mark for lowest wind power price — 1.99 US cents/kWh”, Institute for Energy Economics and Financial Analysis, 13 August 2019, https://ieefa.org/saudi-project-may-set-the-mark-for-lowest-wind-power-price-1-99-u-s-cents-per-kwh/.