For decades, Singapore has been a premier refinery hub and gatekeeper between Asia and the Middle East, but its position is increasingly threatened as producer countries are shifting into the downstream activities that helped make Singapore the “Houston of Asia”. Oil and petrochemicals drive about one quarter of Singapore’s net exports. Greater competition in the global oil and gas value chain could take a heavy toll on the city-state’s national budget and economic growth prospects.

CLICK HERE FOR THE PDF.

By Juergen Braunstein

The global energy mix of the 21st century will be fundamentally different from that of the past. The shale gas revolution, increasing role of renewables, and the effects of global climate change are transforming the energy world as we know it. This transformation creates tremendous opportunities for diversification, but brings new economic risks to small open economies.

While the global energy transition relieves consumer countries of traditional oil and gas supply issues, it puts unprecedented pressure on the business models of petro-states, notably the Gulf Cooperation Council (GCC) countries, and energy transit states like Singapore.

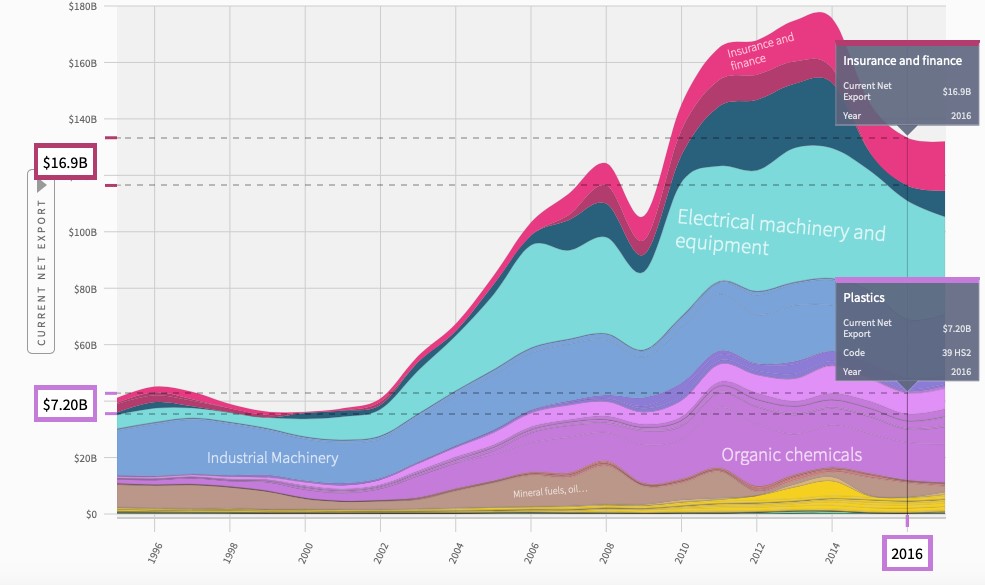

Little noticed by the wider public, since the 1970s, Singapore has been a major beneficiary of the carbon economy. Its economy has been highly dependent on the oil industry and on downstream activities specifically. Singapore generates around one quarter of its net exports from oil-related activities (including petrochemicals and plastics). Petrochemicals and plastics are critical for Singapore’s trade balance. Since the 2000s, petrochemicals and plastics have represented a solid and growing part of Singapore’s net exports — even surpassing services. For example, in 2016, the net export value of plastics was equivalent to almost half of the net export value of insurance and financial services (see Figure 1).

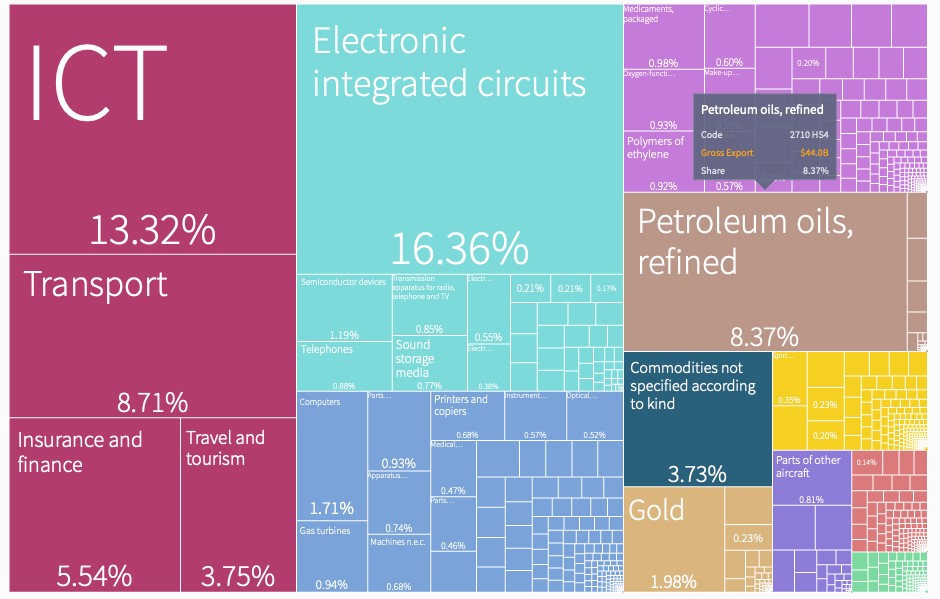

In 2017, with just the exports of oil and refined crude in the forms of plastics and petrochemicals alone, Singapore generated a net-export volume almost as much as Kuwait generated from its total oil export.[1] Singapore imports most of its oil from member countries of the GCC and further processes and re-exports it.[2] In 2017, Singapore had gross fuel imports worth US$73 billion total — by comparison, France had gross fuel imports worth US$59 billion in the same year.[3] Singapore re-exported a part of that in the form of refined petroleum oils (see Figure 2). Another portion of the fuel was used as feedstock for further processing — in the form of petrochemicals and plastics — and export (see the amethyst coloured boxes in Figure 2).

Singapore’s openness makes it vulnerable to international market developments and to energy decisions in Asia and the GCC countries. Located at a critical juncture between the world’s largest energy consumer, China, and the GCC producer countries, Singapore has been at the centre of energy relations between Asia and the Middle East for the past four decades.

See Figure 1: Composition of Singapore’s net exports in US$ billion, 1995–2017

Source: “The Atlas of Economic Complexity”, Harvard University, 2019.

Since the 1990s, Singapore has been able to establish itself as one of the major global oil exchanges. For example, the FOB Singapore price quote has grown to influence about a quarter of the world’s oil market. The prices paid by consumers in the 22 million barrels per day (mbpd) oil markets of Asia and the Middle East are linked to cargo prices set in Singapore.[4] Furthermore, Singapore has been able to establish itself as a global bunkering and storage centre for oil, and as a world trans-shipment centre for breaking down larger oil cargoes for regional markets.

Given its lead in fossil fuel refinement and trading, Singapore occupies a critical role in the global oil and gas value chain. It controls key downstream facilities and has been a premier refinery hub since the late 1980s. At that time Singapore was the third largest refining centre in the world after the US Gulf Coast and Rotterdam. Consequently, Singapore was named the “the Houston of Asia” and “swing” refiner of the Asia-Pacific.[5]

Figure 2. Composition of Singapore’s gross exports (incl. re-exports) in percentage, 2017

Source: “The Atlas of Economic Complexity”, Harvard University, 2019.

But the future of Singapore’s position in the global oil value chain remains uncertain. With producer countries increasingly shifting into downstream activities, intermediaries like Singapore hold less leverage than in the past. The GCC countries in particular will project more international power in the downstream sector in the coming years than in the past.

Abu Dhabi, for example, plans to double its crude refining capacity and triple its petrochemical production, as well as further develop its natural gas business.[6] Last year the chief executive of Abu Dhabi’s National Oil Company announced an investment of US$45 billion to create the single largest integrated refining and petrochemical project in the world.[7] Saudi Aramco’s chief executive, Amin H Nasser, announced his company’s objective of doubling Aramco’s refining capacity from 5 mbpd to 8–10 mbpd over the next decade. Aramco also aspires to shift an additional 2 mbpd to petrochemicals, with the objective of allocating 3 mbpd per day to the petrochemical sector. In addition, Aramco announced an ambitious gas expansion strategy, investing US$150 billion to become an international leader in the integrated gas business.[8] The Kuwait National Petroleum Company, for its part, plans to spend US$25 billion on new downstream projects over the next 20 years.[9]

Additional pressure on Singapore’s entrepot role in energy stems from the new ability of Asian consumer countries to trade directly with producer countries, owing to the growing feasibility of liquefied natural gas (LNG) exports. Increasingly, companies and ship operators are switching to LNG as their preferred fuel.[10] Countries such as Malaysia, South Korea, and Japan are trying to establish themselves as Asia’s next LNG hubs — thereby competing with Singapore in this emerging market.

Furthermore, Asian countries are increasingly searching for alternative energy shipping routes, such as through the Arctic, with the strategic aim of reducing dependence on energy and commodity imports that pass through choke points such as the Straits of Malacca.

The established modus operandi between importing and exporting countries has started to change in the context of the global energy transition. One implication is the weakening bargaining power of transit states, to the advantage of consumer countries, which have more choices in the era of energy abundance. Increasing competition in petrochemicals, especially with the entry of producer countries, also disadvantages transit states in terms of their feedstock position.

The energy transformation is already putting pressure on Singapore’s leading role in the downstream sector, and competition will only increase. Declining downstream activities will adversely affect the city-state’s economic growth prospects and national budgets.

Countries which today import refined petroleum products from Singapore will develop their own capacities and try to integrate these activities of the value chain. These developments diminish Singapore’s bargaining power as a transit state, to the advantage of consumer countries that have more choices in the era of energy abundance.

To avoid economic disruption, Singapore needs to adapt to the global energy transition. The global energy transition is in an early stage, with Asian demand for oil and gas expected to continue growing and alternative shipping routes still taking shape. Yet, Singapore’s relationships with oil producers in the Gulf will have to evolve if it is to remain an integral player in the future energy mix.

About the author

Dr Juergen Braunstein is a research fellow at Harvard Kennedy School’s Belfer Center, where he works on the Geopolitics of Energy Project. His research focuses on the drivers as well as consequences of the green energy “revolution” for the global energy composition and its implications for existing and future interstate relations. Prior to that, Dr Juergen coordinated the “New Climate Economy Special Initiative” on financing the urban transition under the leadership of Professor Nicholas Stern and Mr Felipe Calderon at the London School of Economics (LSE) Cities. Dr Juergen is the author of Capital Choices: Sectoral Politics and the Variation of Sovereign Wealth (University of Michigan Press, 2019). He has a BA from the University of Vienna and a masters and doctorate from LSE.

Image caption: An oil refinery at dusk. Photo: Piqsels.

Footnotes

[1] “The Atlas of Economic Complexity”, Harvard University, 2019; “Observatory of Economic Complexity”, MIT, 2019.

[2] Ibid.

[3] Ibid.

[4] Ng Weng Hoong, Singapore, the Energy Economy : From The First Refinery To The End Of Cheap Oil, 1960–2010 (New York: Routledge, 2012).

[5] Tilak Doshi. “Optimism for the Houston of Asia?” Far Eastern Economic Review, 26 May 1988.

[6] Fareed Rahman, “Adnoc unveils $45b expansion of Ruwais complex”, Gulf News, 13 May 2018, https://gulfnews.com/business/energy/adnoc-unveils-45b-expansion-of-ruwais-complex-1.2220790.

[7] Ibid.

[8] “Aramco plans gas expansion with $150b investment drive”, Reuters, reproduced in Khaleej Times, 27 November 2018, https://www.khaleejtimes.com/business/energy/aramco-plans-gas-expansion-with-150b-investment-drive.

[9] “Kuwait to spend $20 bn on new downstream projects”, Meed, 4 Dec 2018, https://www.meed.com/kuwait-spend-25bn-new-downstream-projects/

[10] For example, see “Deloittte survey reveals LNG is shipping companies’ preferred fuel”, Ship Technology Global, 20 June 2018, https://www.ship-technology.com/news/deloitte-survey-reveals-lng-shipping-companies-preferred-fuel/