By Mattia Tomba

Qatar occupies a small peninsula reaching out into the Persian Gulf between Saudi Arabia and Iran. Its capital, Doha, was a tiny urban settlement with an economy based on fishing and pearling until the 1970s, when the discovery of oil, followed by gas, trigged unprecedentedly rapid economic growth, and initiated the process of urbanization. As a result, Doha became transformed from a small village to an emerging international urban center with a population of more than 2 million residents during the second half of the 20th century. It is now facing a second period of urban transformation led by a new development strategy to diversify its economy, which is now under implementation.

Situated on the east coast of Qatar, Doha is now the major urban center of the country, with more than a 100 different nationalities inhabiting its territory. It is a multi-ethnic city and home to a large community of expatriates. Qatar also has the highest ratio of migrants to citizens in the world, with Qatari nationals making up only 350,000 out of the overall population of 2.4 million. Foreigners therefore account for 86 percent of its total population.

Today, the main source of income for the country is still natural gas, which is sold as liquefied natural gas (LNG). Qatar controls one-third of the global LNG market. The wealth accumulated from oil and gas has allowed the country to become an international financial investor, a major labor importer, an important international donor; and to pursue an assertive foreign policy.

In order to continue this path, Qatar’s strategy is two-fold: it has to maintain a leading role in the global LNG market while diversifying its economy. Tourism has been identified as a fundamental pillar to diversify the local economy, and an incentive to make the country attractive for new international investment. Indeed, the government is focusing on transforming Doha in a cultural and sports center, by hosting many international events like the World Cup in 2022.

Within this context, this work will present an overview of the current economic situation of the country. The paper will start with a short introduction on macroeconomics, and will then cover the monetary policy of the country, analyze its bank system, and conclude with an overview on the gas market, which is the main source of income of the country.

The study will show that Qatar needs to start diversifying its economy, along with maintaining its leadership position in the gas sector, if the country wishes to maintain and preserve its prosperity in the upcoming years. The same strategies apply to other Gulf countries, which share many similarities with Qatar in the economics sector, and should undertake the same path towards diversification.

MACROECONOMICS

The current low oil and gas prices have had a serious impact on the economy. According to the IMF, more than 90 percent of budget revenues and exports are linked to the hydrocarbon sector. Therefore, Qatar’s main risks oil and gas prices remaining low for a prolonged period of time, and an excess of public investment.

In general, the effect of low oil prices are felt after a lag period of one year, but the effect of low gas prices is felt after a lag period of between four to five months. If oil and gas prices stay low for a prolonged period, then growth will slow down, and the private sector will only be partially able to offset the decline.

In 2016, GDP growth is expected to be slightly positive, likely driven by an expansion in the non-hydrocarbon sector and the Barzan gas project that is slated to commence in 2016. Following this, hydrocarbon output will likely flatten.

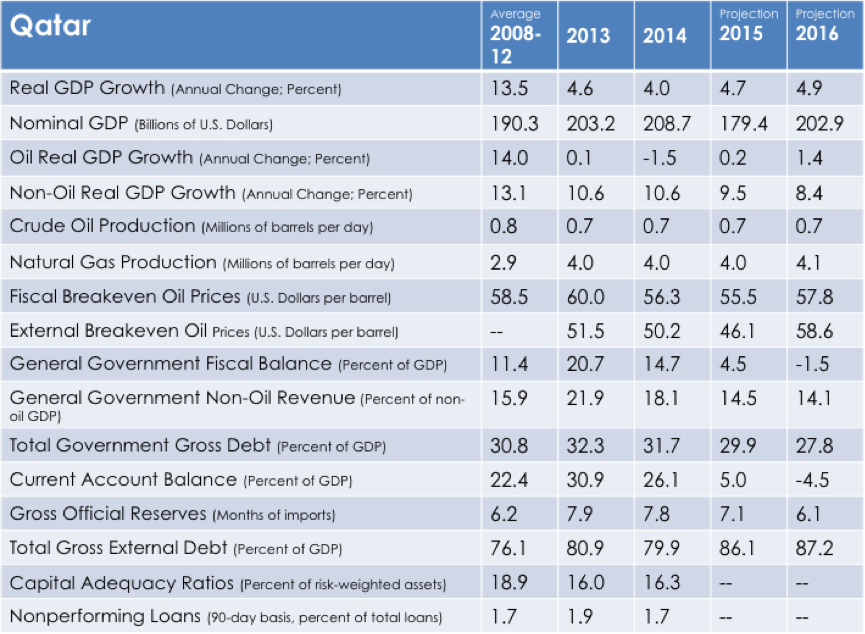

While public investment in the non-hydrocarbon sector is needed to generate growth, excessive spending can overheat the economy and lead to oversupply in the medium term. Since a return to previous prices seems unlikely, fiscal and external balances are likely to deteriorate, leading to a fiscal deficit in 2016, and a negative current account (see Diagram 1).

Diagram 1: Main Qatar economic indicators. Source: IMF Country Report no.15/86 (2015)

At the same time, reserves at the Central Bank and the Qatar sovereign wealth fund (Qatar Investment Authority ÔÇô QIA) are enough to sustain a period of low energy prices. According to the IMF, net foreign assets are currently estimated to be 132 percent of 2015 GDP. The risk therefore applies mainly to future generations who might not have enough resources.

COUNTERING ECONOMIC RISK

Measures to increase state revenues have included the recent reduction in the subsidies for utilities, an increase in corporate taxes, the introduction of real estate fees, and the introduction of Value-Added Tax (VAT), which has been approved recently by the GCC countries and is scheduled to be implemented in a few years’ time.

At the same time, measures to cut expenses have also been included in the 2016 budget approved by the Emir, which assumes an oil price of $ 48 per barrel. Qatar’s planned expenditures will be 7 percent lower in 2016 than in 2015, which would translate into a fiscal deficit of $13 billion. The reduction in expenses will come from cuts in the operating costs of several government departments and government-linked entities/organizations. Healthcare and social housing for Qatari citizens will be the priority for the government, and will receive a corresponding increase in the budget.

In order to cover the shortfall, the government will likely borrow money instead of tapping into the savings held by the Qatar Investment Authority and the Central Bank, preferring instead to re-invest the income from these entities.

Given the large external debt/GDP ratio, Qatar will first try to cover its deficit from domestic sources, as happened last September when local banks bought $4.1 billion worth of Qatar bonds.

MONETARY POLICY

The Qatari riyal, the official currency, is pegged to the US dollar. According to international economics theory, it is impossible to have a stable foreign exchange rate, free capital movement, and an independent monetary policy at the same time. Being pegged to the dollar means that the Qatari Central Bank cannot afford to have an independent monetary policy. While the peg provides stability, it also implies that tightening of US monetary policy will eventually also tighten financial conditions in Qatar.

In the current context the peg is appropriate for Qatar, because the country exports only hydrocarbons (whose prices are in USD and determined on international markets) and imports most of the products it needs. As the dollar is currently strong, the fact that the QAR is pegged to the USD helps in maintaining stability because it reduces the prices of imports. It also does not adversely impact exports since the amount of non-hydrocarbons exports is minimal, thus any appreciation in their prices is not relevant. Moreover ample reserves of USD allow the authorities to maintain the peg easily.

BANKS

The banking sector is sound, but the deteriorating macroeconomic environment could cause liquidity to fall, and increase the percentage of non-performing loans, especially in the real estate sector. Liquidity in the banking sector might fall both due to falling deposits from the government and its related entities, and a tightening in US monetary policy. Thus, borrowing needs may increase, together with the cost of borrowing due to higher perceived risk resulting from continuing low oil & gas prices. Moreover, some Qatari banks have been expanding in other countries in the Middle East and Africa, where the geopolitical environment has become increasingly difficult, thus negatively impacting profitability.

GAS MARKET

Since the sale of natural gas is Qatar’s main source of income for, it is strategically important for the country to maintain a strong position in the market. Not only does Qatar incur low production costs, which gives more room to maneuver but it also shares the largest field in the world, the North Dome, with Iran.

While the Barzan gas project is slated to commence in 2016, the moratorium on the North Dome gas field is expected to remain to avoid a supply increase. Moreover, as result of slashed public expenditures,, two large petrochemicals projects have been canceled.

The price of natural gas started to decline in 2013/2014 because of the warm winters in Europe and Asia, and continued falling the year after due to the simultaneous collapse in oil prices, since long-term gas contracts are oil-indexed. New LNG projects are now being challenged by unfavorable economics, but recent competing projects in Australia and the US are challenging the regional gas equilibria against the backdrop of a slowing Asian market. Europe will end up absorbing excess supply at a time of limited demand growth and declining domestic production.

The factors driving the global demand of natural gas are:

Demand from Asia. Japan, Korea, and Taiwan accounts for 75 percent of the Asian market. The demand from these countries is not only stagnant, but declining in places like Japan due to the gradual re-activation of its nuclear plants. There is also high uncertainty on the growth of demand from China.

Demand in Europe. Demand is not growing, but production is declining. The UK, Netherlands, and Norway are the main producers in Europe. Their fields have all reached maturity, and production levels in the UK and Netherlands are also declining. It is not clear how far and to what extent oil, coal, and renewable energies can replace natural gas, but there is a gap to fill.

New markets are opening, such as bunkers for marine transportation fuel.

The factors driving the global supply of gas are:

Export capacity of US LNG players.

Export capacity of Australia, East Africa, East Mediterranean, Canada, and Russia. While Australia has already started production, projects in the other countries may be canceled or delayed due to the low gas prices.

Russian exports to Europe and China. LNG players will challenge Russia pipeline exports to Europe; hence, Russia will have to decide on a strategy of ‘low volume, high price’, or ‘high volume, low price’.

While it is difficult to predict how Russia will maintain its dominance in Europe, a weakening of its position will benefit LNG players such as Qatar and the US.

Another market that can see an increase of gas purchases from Qatar is Turkey. Due to the current confrontation between Turkey and Russia, Turkey needs to diversify its sources of energy. It is the second-largest buyer of Russian natural gas, which supplies 55 percent of its national gas needs. The easiest solution for Turkey is to increase imports from Azerbaijan through the Trans-Anatolian pipeline, and the Trans-Adriatic pipeline over the coming years, but it still needs to look elsewhere to truly diversify its energy imports. Qatar is an attractive alternative.

In addition, the regasification capacity in Turkey is limited; there are only two liquefied natural gas import terminals, at Marmara Ereglisi (8.2 bcm annual capacity) and Aliaga (5 bcm annual capacity). While it is expensive and takes a long time to build new regasification plants, the current geopolitical situation can be a trigger to invest in new plants to import LNG cargos that Qatar can supply.

CONCLUSION

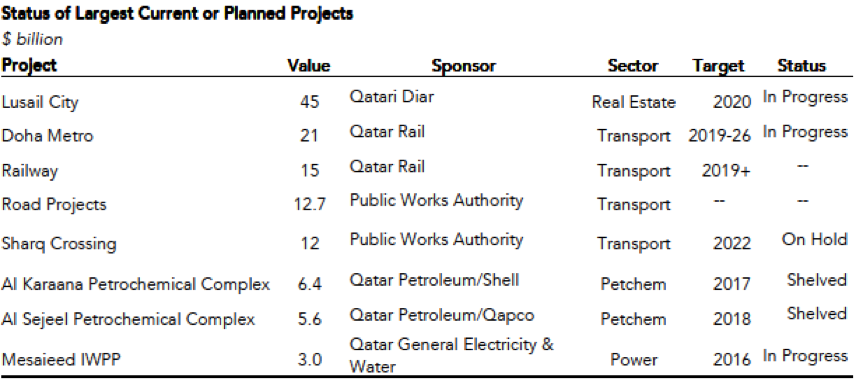

Qatar’s economic growth in the last two decades has been driven by asset accumulation through high public spending, mainly on infrastructure and real estate. The result has been an increase in GDP, but not in productivity. Diversification, private sector development, and fiscal consolidation are necessary to improve productivity. Thus, low oil and gas prices can push Qatar in this direction. Indeed, the government has started a process of fiscal consolidation by cutting current expenditures and non-core projects (See Diagram 2).

Diagram 2: Main projects in Qatar. Source: II . Qatar, the boom goes on (2015).

In order to preserve the wealth accumulated over the last few years, Qatar needs to maintain a strong position in the global natural gas market, while simultaneously diversifying its economy. Recently the government has taken some measures to improve the business environment and promote diversification including an increase of foreign ownership of Qatari companies in selected sectors, and a merger of Qatar Development Bank with Qatar Enterprise to better support small and medium enterprises (SMEs). Going forward, other measures can be taken to simplify the various bureaucratic procedures that complicate doing business in the country.

Diagrams references:

IMF (2015). Main Qatar economic indicators. Country Report no.15/86. Available at: https://www.imf.org/external/pubs/cat/longres.aspx?sk=42821.0

IIF (2015). Qatar, the boom goes on. Main projects in Qatar. Available at: https://www.iif.com/publication/research-note/qatar-boom-goes

Mattia Tomba is Qatar Fellow in Gulf Studies at MEI and a multi-disciplinary investment professional based in Qatar with a track record of investments and acquisitions in different asset classes, sectors, and geographic areas. He has extensive experience in evaluating, negotiating, and structuring direct investments globally across all parts of the capital structure, in public and private markets. In 2008 he joined Qatar’s Sovereign Wealth Fund (Qatari Diar), where he has been managing an equity portfolio, and working on large private equity and real estate transactions worldwide. Previously he was part of the Goldman Sachs Group in the Principal Investment Area (Whitehall Real Estate Funds), where he was involved in portfolio management, and in strategic planning of large European acquisitions. He began his career with the Private Wealth Management team of Merrill Lynch. He is a graduate of Fletcher School, Tufts University (Boston, US), and Bocconi University (Milan, Italy)/Science Po (Paris, France).