By Vandana Hari

Please CLICK HERE for a PDF DOWNLOAD

A historic framework deal between Iran and six world powers announced April 2, 2015 has grabbed the attention of oil markets for its potential to end a 13-year standoff over the Islamic republic’s nuclear program, freeing it from crippling sanctions and thus boosting its crude production and exports.

Under the “joint plan of action” agreed in Lausanne with the P5+1 countries ‘ US, UK, Germany, France, Russia and China ‘ following 18 months of intensive bargaining, Iran agreed to curbs on its controversial uranium enrichment program and inspections by the International Atomic Energy Agency. The negotiators are now working toward a comprehensive agreement, with a deadline of June 30.

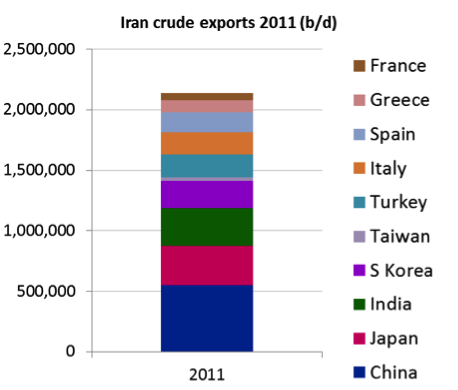

Iran currently exports on average around 1 million b/d of crude, less than half the 2.2 million-2.3 million b/d it sold overseas before the imposition of the latest round of oil and financial sanctions by the European Union and the US in 2012.

An EU embargo meant that some 500,000 b/d of Iranian oil could no longer move to Europe. With the loss of France, Greece, Spain and Italy as buyers, Iranian crude exports became limited mostly to Asia ‘ China, Japan, India and South Korea being the main markets, with the rare shipment to Taiwan, and outside the region, Turkey. But even these supplies were crimped by payment and tanker insurance restrictions imposed by the sanctions.

Source: Official data from the countries

Oil minister Bijan Zanganeh has repeatedly said his administration is capable of supplying an additional 1 million b/d of crude to world markets in a matter of months. Consensus expectations of market analysts point to a 500,000 b/d to 600,000 b/d rise in exports relatively quickly ‘ perhaps by the end of this year ‘ though some caution it could take longer, given the lack of clarity on the pace and timing of the removal of sanctions.

US Secretary of Energy Ernest Moniz, a key member of the US negotiating team, said April 20 he believed Iran would require six months to meet the conditions laid down in the framework agreement.

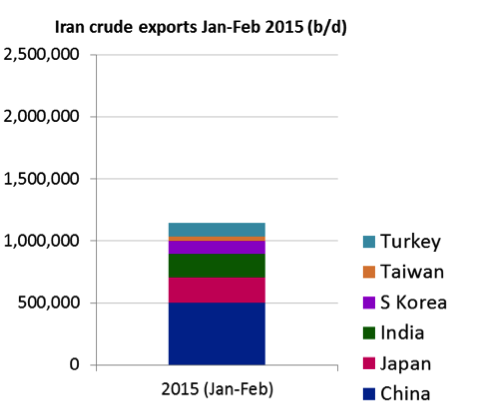

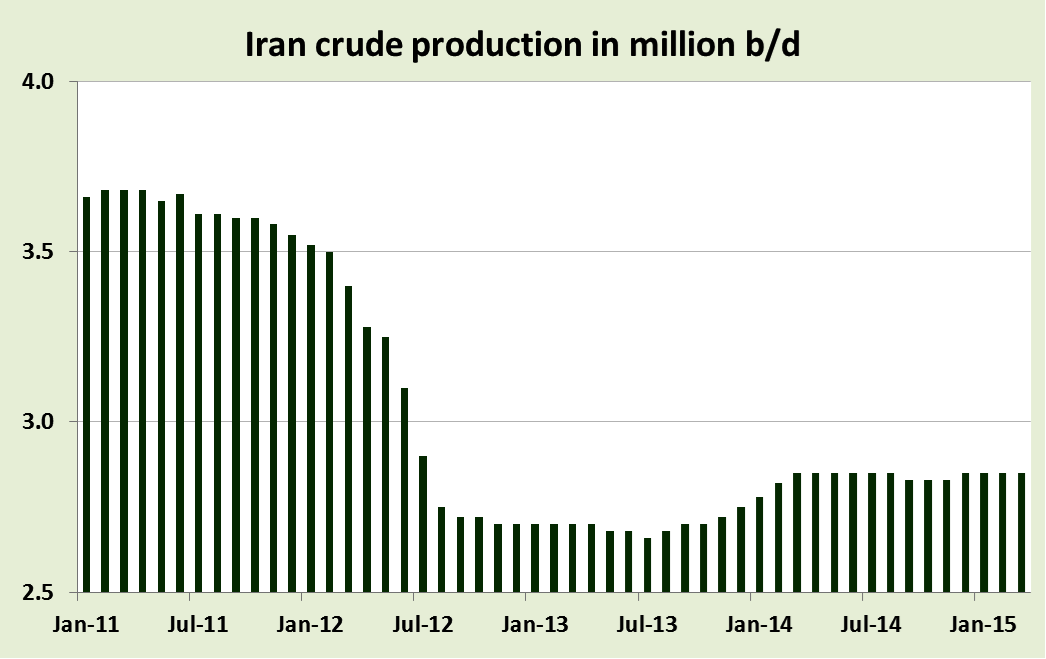

Iran should be able to ramp up output to between 3.4 million b/d and 3.6 million b/d within months of sanctions being lifted, from current levels of around 2.8 million b/d, the International Energy Agency said in its monthly report April 15.

Platts surveys show Iranian production averaged 2.85 million b/d in March, down 21.5% from an average of 3.63 million b/d in 2011.

Source: Platts monthly OPEC production surveys

Projections for a swift increase of up to 600,000 b/d take into account work carried out on some of the country’s core oil fields during the sanctions years, pressure build-up caused by the shutting down of large volumes, and barrels in floating storage that could be mobilized quickly.

The IEA estimates some 180,000 b/d could flow out from oil stored in Iranian tankers over a period of six months, going by reports of around 30 million barrels in floating storage in the Persian Gulf.

Zanganeh, though, has said the estimates are overdone, and that Iran has 20 million barrels of condensate in floating storage, which it would sell gradually so as not to disrupt markets.

Platts understands from market sources that indeed not all tankers anchored off Kharg Island and Assaluyeh are fully laden, and variously hold Iranian crude, condensate, and even fuel oil.

OIL MINISTER ZANGANEH PUTS OPEC ON NOTICE

Mindful of the lingering global supply glut, within days of the framework deal, Zanganeh had issued a call to fellow OPEC members to prepare to accommodate higher Iranian flows, even as he ordered key domestic oil and shipping companies to take the necessary steps to boost production and exports once sanctions are lifted.

“We believe OPEC’s production should decrease by 5% so that the market is balanced. In addition, market share is not something that we [Iran] will give up,” Zanganeh was quoted as saying by local news agencies April 14.

The minister had earlier slammed OPEC’s policy of setting an overall crude output ceiling without defining individual country quotas. Since the beginning of 2012, the producers’ group has had a 30 million b/d ceiling in place, but no quotas for the 12 member countries.

“This means that some countries take other members’ shares and if others want to come back to the market, they must fight…not a problem. We fight and won’t let go of one barrel of our previous share,” Zanganeh told reporters at a ceremony in Assaluyeh March 17 to mark the completion of Phase 12 development of the giant South Pars gas field.

“It is paramount for Iran to get its production back, regardless of where this drives prices,” Fereidun Fesharaki, chairman of the London-based consultancy Facts Global Energy, said at the Middle East Petroleum and Gas conference in Abu Dhabi April 21. “It is not all about money. Being taken seriously in the global oil market is just as important.”

The question of where the additional Iranian volumes can go in a relatively weak and oversupplied market remains.

National Iranian Oil Company managing director Rokneddin Javadi told reporters at the event in Assaluyeh that Europe was most certainly one of the potential markets for the incremental Iranian barrels, and his company had already held some talks with European refiners.

China is expected to import more Iranian oil as a result of a visit by a high-ranking delegation led by Zanganeh to Beijing April 9-10, though details of the timing or the size of increase in oil sales are not known.

Iran’s largest crude buyer before as well as through the sanctions regime, China, currently imports about half a million barrels per day from the country.

The removal of sanctions would not only enable Iran to sell more oil, but should also free up more than $100 billion of its oil revenues currently blocked in foreign banks due to money transfer bans, as well as open the door to foreign investment in its underdeveloped energy sector.

Though US congressional laws against Iran will likely remain in place, including sanctions on upstream investment, non-US companies may be given a reprieve on this. Iran, though, is expected to take some time to launch its new upstream model contract, aimed at replacing the conventional “buyback” formula with a more attractive framework. The IEA expects billions of dollars to flow into Iran’s oil fields, boosting its capacity to around 4 million b/d by the end of the decade.

Vandana Hari is Asia Editorial Director at Platts, a division of McGraw Hill Financial and a leading information provider on the global energy, petrochemicals, metals and agricultural markets. She oversees Platts’ editorial operations in Asia, spanning the oil, petrochemicals, agriculture, metals, steel raw materials, coal, and LNG teams. Vandana has been with Platts for 20 years, working in Hong Kong and Singapore. Prior to taking over as editorial director for the company’s Asia operations in mid-2010, Vandana served in roles leading the regional oil and gas news coverage, reporting on the crude oil markets, and managing the editing desk. Vandana has a Bachelor of Science degree from India’s MD University and post-graduate diplomas in communication and social journalism. She has reported and edited for newspapers and news magazines in India and Hong Kong. She is a regular commentator on the energy industry in the print media as well as on prominent radio and television channels.