Qatar Insights Series – A Note from the Editorial Team

Qatar is one of the richest countries in the world. However, its domestic food production is so low that over 90 percent of its food supply has to be imported. This article provides some stylised facts on Qatar’s food security, including the effects of the June 2017 blockade on food supply. It also offers some insights on how to shore up Qatar’s food security in the future.

By Hela Miniaoui, Patrick Irungu & Simeon Kaitibie

State of food security in Qatar

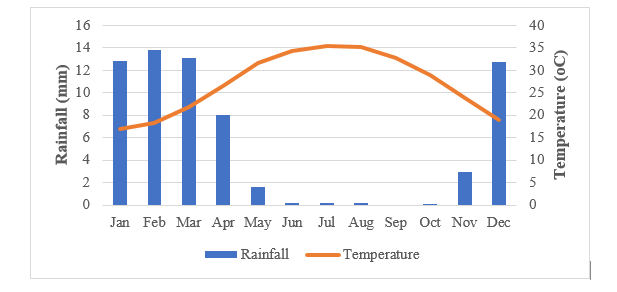

Despite being the richest country in the world, with a Purchasing Power Parity (PPP)-adjusted per capita income of US$118,207, [1] Qatar’s food production is very low, thanks to its high aridity, poor soils and low rainfall. For example, only 1.1 percent of the country’s land area of 11,610 sq km is arable. Being a desert country, the quintessential challenge to agricultural production in Qatar is water scarcity. Reports indicate that Qatar’s aquifers are technically depleted, while the combination of low rainfall and high temperature is too harsh to support significant agricultural production (Figure 1).

Figure 1. Average rainfall and temperature in Qatar (1901–2015)

Source: World Bank (2018) [2]

On the other hand, Qatar’s sandy-lime soils are unable to support sufficient plant growth as they inordinately suffer from poor fertility, characterised by high porosity and salinity. As a result, only small-scale agriculture is practised in Qatar, mainly under irrigation using hydroponic technologies. The main crops grown are dates and vegetables (tomatoes, pumpkins, eggplants, onions, and chillies).

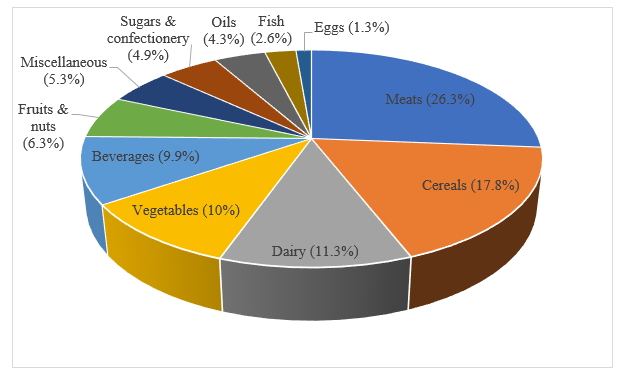

Against this background, Qatar relies almost exclusively on food imports to feed its population of 2.7 million. [3] In particular, Qatar imports about 90 percent of its food requirements from more than 100 countries. For example, between 1998 and 2017, Qatar spent QAR 105.78 billion (US$28.97 billion or US$1.45 billion annually) on food imports, comprising mainly meats, cereals, dairy, and vegetables (Figure 2).

Figure 2. Composition of food imports in Qatar (1998–2017)

Source: Ministry of Development Planning and Statistics (2018) [4]

The main sources of the different food commodities shown in Figure 2 above are listed in Table 1. The table demonstrates the huge diversity of food sources for Qatar. Notably, Saudi Arabia and the United Arab Emirates (UAE) rank among the most important sources of poultry, milk, onions, and potatoes (Saudi Arabia), and goat and barley (UAE).

Table 1. Qatar’s major food imports by category and main sources (1998–2017)

| Food category | Commodity | Import value within food category (%) | Main sources |

| Meats | Poultry | 53.6 | Brazil, Saudi Arabia, USA |

| Sheep | 23.5 | Australia, India, New Zealand | |

| Beef | 14.1 | Australia, India, USA | |

| Goat | 4.9 | Australia, India, UAE | |

| Cereals | Rice | 64.2 | India, Pakistan, Thailand |

| Wheat | 17.8 | Australia, Russia, Canada | |

| Barley | 10.3 | Ukraine, Australia, UAE | |

| Corn | 2.8 | Argentina, Brazil, India | |

| Dairy | Milk | 50.8 | Saudi Arabia, Netherlands, Germany |

| Cheese | 23.4 | Saudi Arabia, France, Egypt | |

| Yoghurt | 16.0 | Saudi Arabia, UAE, Turkey | |

| Butter | 5.0 | Denmark, New Zealand, Saudi Arabia | |

| Cream | 2.3 | United Kingdom, Brazil, Denmark | |

| Vegetables | Leeks | 15.6 | India, Netherlands, Lebanon |

| Parsley | 13.0 | India, Netherlands, Lebanon | |

| Onions | 9.6 | India, Pakistan, Saudi Arabia | |

| Potatoes | 9.5 | Egypt, Saudi Arabia, Lebanon | |

| Tomatoes | 8.7 | Jordan, Syria, Morocco |

Source: Ministry of Development Planning and Statistics (2018)4

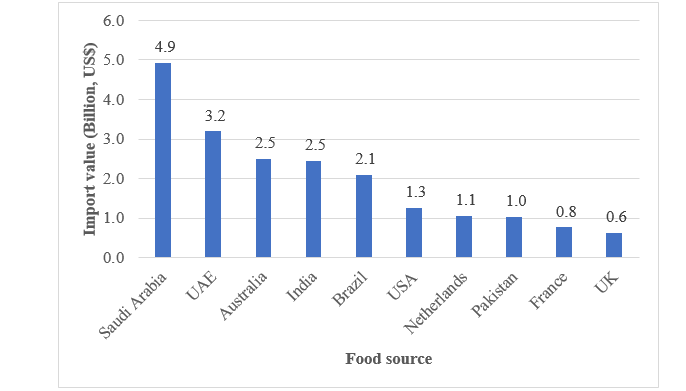

Before the 5 June 2017 air, sea, and land blockade imposed on Qatar by Saudi Arabia, UAE, Bahrain and Egypt, Saudi Arabia and UAE accounted for 27.4 percent of Qatar’s total food imports by value. During this time, over 40 percent of Qatar’s food imports came overland through Saudi

Arabia. The top 10 food-source countries before the embargo are shown in Figure 3. These countries accounted for two-thirds of Qatar’s food imports.

Figure 3. Top 10 food import sources for Qatar (1998–2017)

Source: Ministry of Development Planning and Statistics (2018)4

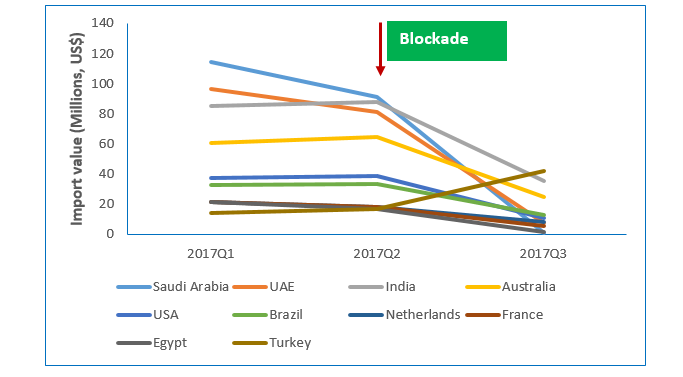

During the blockade, Saudi Arabia’s food exports to Qatar dropped by 20.2% in the second quarter (Q2) of 2017 and by a massive 99.3% in Q3 (Figure 4). However, Saudi Arabia still maintained its status as the lead exporter in Q2. The UAE was replaced by India in second place. Newcomers to the top 10 food exporting countries in Q2 were Oman (number 7) and Jordan (number 10), with Egypt exiting the list. In Q3, Saudi Arabia, France, and Jordan dropped from the list. Turkey emerged as the leading food source in this period, with a 190.7% increase over its Q1 export value. Kuwait and Lebanon made it to the list, at numbers 8 and 10 respectively, while the UAE dropped from position 2 in Q1 to position 9 in Q3.

Figure 4. Effect of the blockade on Qatar’s food import value (2017 Q1–Q3)

Source: Ministry of Development Planning and Statistics (2018)4

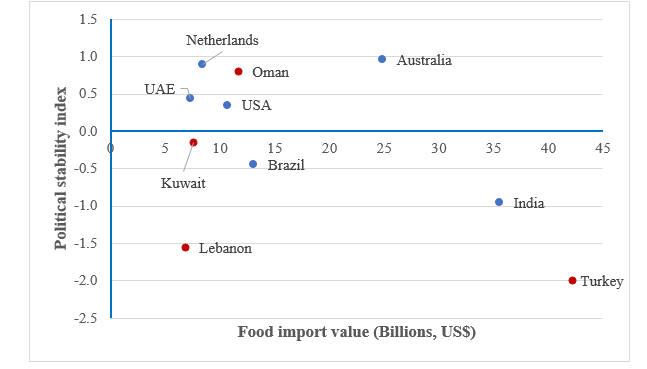

Significantly, three of the four newcomers among Qatar’s food sources after the blockade in 2017 Q3 were politically unstable, as indicated by their low political stability indices in 2016: Turkey (-2), Kuwait (-0.15) and Lebanon (-1.56) (Figure 5). Only Oman was relatively politically stable, at 0.80. This suggests that while Qatar could be diversifying its food imports away from “trouble-spot” countries (i.e., Saudi Arabia, UAE, and Egypt), it could increasingly be exposed to considerably high political risk in its new food source countries.

Figure 5. Relationship between import value and political stability in Qatar’s food-source countries in 2017 Q3

Source: World Bank (2017); [5] Ministry of Development Planning and Statistics (2018)4

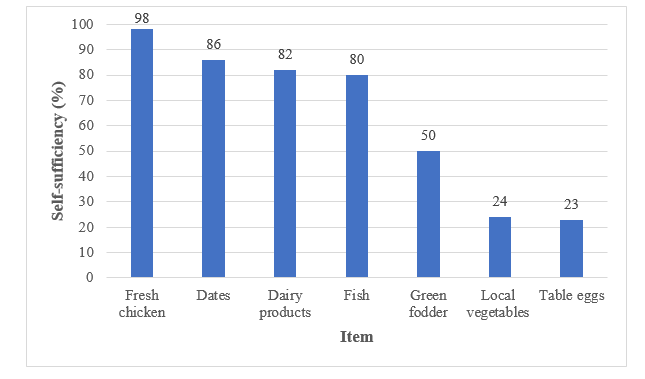

One of the positive outcomes of the blockade is that it has galvanised Qatar to exploit its own agricultural production potential. Accordingly, the government of Qatar, in collaboration with the private sector, has initiated an unprecedented import-substitution strategy focused on local production. In April 2018, the Ministry of Municipality and Environment[6] announced that Qatar had achieved 98, 86 and 82 percent self-sufficiency, respectively, in fresh chicken, dates, and poultry products (Figure 6). Further, the ministry expects Qatar to be 70, 90, and 100 percent self-sufficient in fresh vegetables, table eggs, and fish and shrimps, respectively, within the next two years. Self-sufficiency in milk and dairy products will be achieved within the next eight months.

Figure 6. Level of food self-sufficiency in Qatar based on local production

Source: Ministry of Municipality and Environment (2018)6

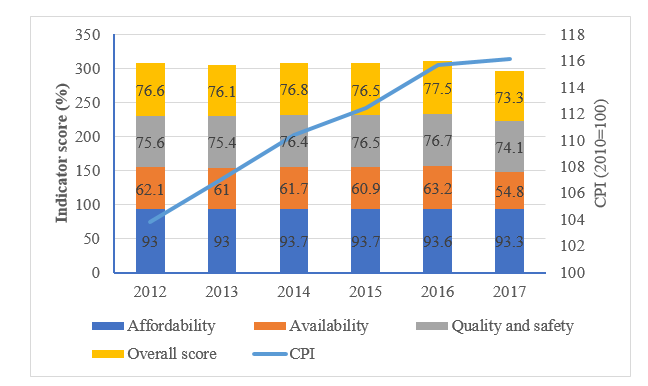

Qatar’s high income and the evolving import-substitution efforts have enabled it to achieve a relatively high level of food security[7] based on food imports. With regard to the three indicators of food security, Qatar often scores highly on food affordability (Figure 7). However, the rising price inflation depicted by Consumer Price Index (CPI) is likely to compromise food affordability, especially among low income migrant workers. Understandably, Qatar scores relatively low on food availability compared to countries with similar income mainly due to low domestic production. For example, Qatar’s food availability score fell by 15.3 percent from its highest level ever of 63.2 percent in 2016 to a low of 54.8 percent in 2017, perhaps reflecting the adverse effects of the blockade. On the other hand, Qatar has maintained a relatively high level of food quality and safety, with an average score of 75.8 percent between 2012 and 2017. Its relatively high food security has translated into high nutrition outcomes; e.g., only 11.6 and 4.8 percent of children under 5 years were respectively reported stunted and underweight in 2017. [8] Unfortunately, the prevalence of obesity is rising, e.g., from 35 percent in 2012 to 36.9 percent in 2017.8

Figure 7. Trend of Qatar’s food security and consumer price index (2012–2017)

Source: Economist Intelligence Unit8

Key players in Qatar’s food security space

The key players in Qatar’s food security effort include local Qatari farmers, who own a total of 1,400 farms. About 200 of these farms use modern technologies to produce vegetables in open irrigated land during cool seasons while others produce eggs and dairy products for the local market. Following the recent blockade, the Qatari government is increasingly emphasising local production as an avenue to substitute food imports and diversify the economy. In January 2018, the Ministry of Municipality and Environment announced US$19.2 million [9] of government support to local farmers. However, local production is still below that needed to make Qatar fully self-sufficient in most agricultural commodities.

The other major player in Qatar’s food sector is Hassad Food Company (HFC), [10] a subsidiary of Qatar Investment Authority. HFC operates large-scale farms leased and/or bought overseas to supplement domestic supply. Established in 2008, HFC operates farms in Qatar, Australia, and Oman and is considering expanding to other countries in South America, Africa and Asia. As of 2017, HFC owned a quarter of a million hectares of agricultural land in Australia, [11] where it produces sheep and wheat. In Oman, the company produces and ships about 22,000 tons of poultry10 products annually to Qatar.

Perhaps the most active players in Qatar’s food security sector are the thousands of small and medium enterprises (SMEs) [12] involved in food import and distribution. SMEs in Qatar are either foreign-owned, private entities, or publicly listed companies. A key attribute of these SMEs is that they are highly concentrated within their business lines. [13] The high concentration not only reduces competition and associated innovation in the food import sector but also exposes Qatar to considerable risk of political, climatic and/or disease-related supply disruptions. This concentration has been responsible for “passport pricing” of food commodities in various outlets in Qatar irrespective of quality and transportation cost differentials for similar food items.

Strategies to enhance food security in Qatar

With rising domestic production and diminishing international attention against large-scale foreign land purchases and leases for food production, Qatar’s national food self-sufficiency goal faces a less precarious future. In spite of this, Qatar could focus on the following strategies to enhance its food security:

- Continuing to import food as the most cost-effective and viable complement to the rising, albeit limited, domestic food production. However, Qatar should diversify its food import sources, perhaps focusing more on politically stable countries.

- Escalating contract farming in developing countries, especially in Africa (e.g., countries in the Qatari-led Global Dryland Alliance [14]) and Asia. This would realise a win-win solution in guaranteeing Qatar sufficient food supplies while at the same time reducing poverty in developing countries.

- Developing a strategic food reserve by importing large quantities of food to add value for re-export. Large-scale imports will lower procurement costs through economies of scale. It has been shown that a Qatari Riyal spent on food security (e.g., value-added processing) would generate an extra 2.5 Riyals of economic activity. [15]

- Reforming the food import sector to make it more broadly competitive, efficient, and innovative.

- Reducing food waste. Evidence shows that an average of 636 kg of food is lost per person per year (or 1.74 kg per person per day) [16] in Qatar, mainly along the supply chain before it reaches the table. Reduction of the huge waste could reduce Qatar’s food import bill and help in conserving water, energy, and environmental resources.

- Investing in agricultural research and development for new cost-effective and sustainable agricultural technologies and innovations focusing on renewable energy, efficient water use, circular economy, and re-charging Qatar’s depleted aquifers.

[1] Databank, World Bank, http://databank.worldbank.org/data/home.aspx

[2] Databank, World Bank, http://sdwebx.worldbank.org/climateportal/index.cfm?page=downscaled_data_download&menu=historical

[3] Qatar Monthly Statistics, Statistics of March 2018. Ministry of Development Planning and Statistics, Qatar, 2018, www.mdps.gov.qa/en/statistics/StatisticalReleases/General/QMS/QMS_MDPS_51_Apr_2018.pdf

[4] Foreign Trade System (FTS), Ministry of Development Planning and Statistics, Qatar, 2018, ftq.mdps.gov.qa:80888

[5] Databank, World Bank, https://datacatalog.worldbank.org/dataset/worldwide-governance-indicators

[6] Statistics, Ministry of Municipality and Environment, Qatar, https://www.mdps.gov.qa/en/statistics1/Pages/default.aspx

[7] The World Food Summit (1996) says “… food security exists when all people, at all times, have physical, social and economic access to sufficient, safe and nutritious food which meets their dietary needs and food preferences for an active and healthy life”. Rome Declaration on World Food Security, World Food Summit, http://www.fao.org/docrep/003/w3613e/w3613e00.HTM

[8] The Economist Intelligence Unit, , Global Food Security Index Findings and Methodology, 2017, http://foodsecurityindex.eiu.com/

[9] Ataullah, Sanaullah, “Local farm expects 30% surge in yield,” The Peninsula, Jan 7, 2018, https://www.thepeninsulaqatar.com/article/07/01/2018/Local-farm-expects-30-surge-in-yield

[10] Website of Hassad Food Company, http://www.hassad.com/English/AboutUs/Pages/default.aspx

[11] Company Overview of Hassad Food Company, https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=102038657

[12] According to Qatar Development Bank (2016), a SME in Qatar is one that employs fewer than 250 persons and has an annual turnover of less than QAR 100 million. The State of Small and Medium Enterprises in Qatar, Qatar Development Bank, https://wlabdemo.com/qdb_sliced3/The%20Satate%20of%20SMEs%20in%20Qatar-2016_EN-Web%20-%20P.pdf

[13] Basher, Syed Abul, David Raboy, Simeon Katibie, Ishrat Hossain, “Understanding Challenges to Food Security in Dry Arab Micro-States: Evidence from Qatari Micro-Data,” Journal of Agricultural & Food Industrial Organization 11, no.1 (2013): 1–19.

[14] The Global Dryland Alliance (GDA) is “an initiative created to establish an international organization to face food insecurity consequences and negative environmental and economic impacts associated with climate change” in dryland countries. Its formation was announced by the Emir of Qatar, at the 68th UN General Assembly. See http://www.globaldrylandalliance.org/en/about-us/

[15] Katibie, Simeon, Munshi Masudul Haq and Manitra A. Rakotoarisoa, “Analysis of Food Imports in a Highly Import Dependent Economy,” Review of Middle East Economics and Finance (2017): 1-12.

[16] Adema, Sybrandus, EcoMENA, Mar 9, 2016, http://www.ecomena.org/food-waste-in-qatar/

Dr. Hela Miniaoui is an Associate Professor of Economics in the Gulf at Gulf Studies Center, Qatar University. She holds a PhD in Economics from University of Tunis El Manar, Tunisia. Her research focuses primarily on Economic Policies, Sustainable Development, Food Security and Islamic Banking & Finance, and it has been published in various refereed journals. Dr Hela has consulting experience with African Development Bank Group, Awqaf New Zealand and IDEA-Consult Tunisia. She serves on the editorial and review committee of several international journals. She is a member of The Middle East Economic Association (MEEA) and a research fellow at The Economic Research Forum (ERF).

Dr Patrick Irungu is a Researcher at Qatar University. He previously worked as a Lecturer at the University of Nairobi, Kenya, where graduated with a PhD in Agricultural Economics in 2011. He has over 15 years of research experience in agricultural economics with key interest in food security, value chain analysis and trade policy, and has published widely on these areas in peer-reviewed international journals. Dr Irungu is also a renowned consultant in the field of Agricultural Economics.

Simeon Kaitibie is Associate Professor of Economics at Qatar University. He holds a PhD in agricultural economics from Oklahoma State University, USA, and has several years of teaching and international agricultural research and development experience. He previously worked for the International Center for Agricultural Research in the Dry Areas (ICARDA) in Aleppo, Syria; the International Livestock Research Institute (ILRI) in Nairobi, Kenya; the Department of Agribusiness and Applied Economics at North Dakota State University in Fargo, North Dakota (USA); and the Institute of Agricultural Research in Sierra Leone. He has published and made scholarly contributions to knowledge in agricultural economics, the economics of food safety, international trade, food security, agricultural livelihoods and policy oriented research impact assessment. He was consultant economist at Qatar National Food Security Programme, and served as resource person and team member in both the development of the Qatar Master Plan for Food Security and the mid-term review of Qatar National Development Strategy 2011-2016.