Credit-Risk Sharing in Islamic Banking: The Case for Islamic Deposits and Investment Accounts (IA) in Malaysia

By Saiful Azhar Rosly

This paper argues that the introduction of the investment account (IA) in Islamic banking amongst others should reduce potential Shariah non-compliance risk arising from the disproportionate distribution of income to depositors and banks. While impairment expenses are charged to depositors, the returns on mudaraba deposits (ROMD) do not seem to favour depositors as the ROMD has been consistently lower than return on equity (ROE) despite evidencing some form of credit-risk sharing between banks and mudaraba depositors as outlined by Framework of Rate of Return of Bank Negara Malaysia. When investment accounts are channeled to fund murabaha transactions, the credit risk should be solely carried by the IA holders and hence, the return on investments accounts (ROI) can be the reference point in assessing the risk-taking activities of investment account holders which is comparable to the ROE of bank’s shareholders.

Keywords: credit-risk sharing, rate of returns on mudaraba deposits, investment accounts

Banks take deposits in order to make loans to borrowers. In the Islamic banking business, the extension of financing to customers is mainly funded by deposits, comprising of transaction and term deposits contracted on mudaraba and wadiah principles respectively. The nature of mudaraba contracts warrants the sharing of profit and loss of the related exposure between depositors and bank while wadiah contracts specify the protection of savings, hence the taking of loss by the bank alone. While banks can acquire funds from non-deposit sources such as the money market, this paper will give focus only on issues related to deposit funds.

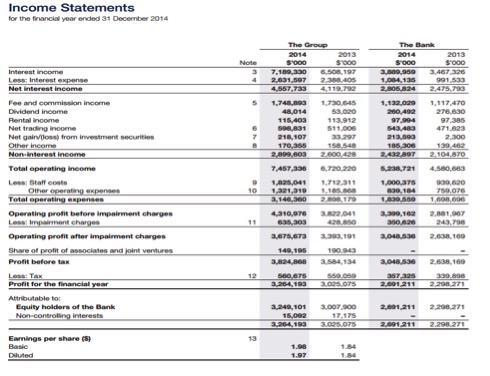

Banks also hold capital against their lending driven by deposit funds. The high cost of capital does not merit banks using capital to make loans, hence making loans from borrowed funds has been the traditional banking model, which is also true for Islamic banks. Profits are mainly derived from the difference between rates charged on loans or financing and rates paid to depositors. Since, there is a likelihood that loans may not be paid in full, potential loss is absorbed by banks through the provision on loan impairment. For example, in 2014 UOB provided a sum of S$635,303 for the impairment expenses which is charged to net income of the bank at S$4,557,733 million. Table 1 below:

Table 1: Overseas Union Bank (OUB) Profit and Loss Statement 2014.

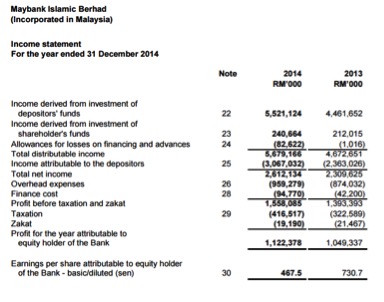

Following Table 2 for Maybank Islamic, a similar approach of impairment charges may not hold for Islamic banks as some banking exposures were funded by mudaraba deposits which in principle are based on equity contracts. As such, the charging of the impairment expenses of RM82.62 million was made to the shareholders and as well as to the mudaraba depositors on the accumulated revenues of RM5.761 billion million which leaves RM5.68 billion for distribution. The income attributable to depositors of RM3.06 billion constitutes the cost of deposits, comprising of mudaraba and non-mudaraba deposits which is net of the impairment expenses. This is a significant departure from conventional practices where in the latter the impairment expenses were only charged to the shareholders (see Table 1) which means that risk of default is only carried by the bank. The practice is in line with Bank Negara Malaysia’s guideline on Framework of the Rate of Return (FROR) asserting that “this is in accordance with the mudharaba contract whereby the provisions in Islamic banking operations are shared by both the depositors and the bank, unlike conventional banking operations where the provisions are solely borne by the bank” (BNM/RH/GL 007-5 2013).

Table 2: Maybank Islamic Income Statement 2014.

Credit-Risk Sharing in Islamic banks

Based on Table 2, some form of credit risk-sharing is visible in Islamic banking where risk of default was taken by both bank and the depositors. This is true for mudaraba deposits only while non-mudaraba deposits contracted under the wadiah and commodity murabaha principles are not expected to absorb potential loss from default. The FROR provides clear guidelines on the sharing of profit and loss in the Islamic banking operations so as to manifest fairness and justice in the distribution of profit as defined by the mudaraba contract. The FROR says:

“The need for the framework arises from the contractual relationship in Islamic banking, particularly the mudharabah (profit-sharing) contract between the depositors and the Islamic banking institutions (IBIs). Under the mudharabah contract, a depositor that deposits his funds with the IBI also assumes the role as capital provider. The IBI assumes the role as the entrepreneur where it will invest the depositor’s funds. Profits accrued from investment and financing are shared between the depositor and the IBI based on pre-agreed profit sharing ratio. Losses, if any, will be borne by the depositor, except in cases where there is evidence of negligence by the IBI in managing the depositor’s funds. Given this unique relationship where the depositors would have a direct financial interest in the IBI, a standard calculation of the rate of return is imperative to ensure that depositors will receive their portion of the investment profits in a fair and equitable manner. It will also address the BNM/RH/GL/007-5 Islamic Banking and Takaful Department Framework of Rate of Return Page 3/44 information asymmetry between the IBI and its depositors by enhancing the level of transparency of Islamic banking operations” (BNM 2013).

To that effect, the FROR provides a method of deriving net distributable income and the distribution of profits to depositors via the 1) calculation table (CT) and 2) distribution table (DT) with an objective to set a minimum standard in calculating the rate of return and providing Islamic banks with better means of assessing the efficiency of Islamic banking institutions (IBIs) as well as their profitability, prudent management and fairness. Hence, all financial reports issued by IBIs relating to distributable income and income distributed to depositors are derived from the methodology of the FROR, which this study uses to compute the return on mudaraba deposits (ROMD)

The Calculation Table (CT)

The CT provides the methodology in deriving the net distributable income which amounts to RM2.35 billion for BIMB, which this study uses as the case bank. The CT defines specific expenses as deductible and non-deductible items. Deductible items include the impairment loss, income-in-suspense, direct expenses and profit distributable to other related parties i.e. specific investment deposit holders, bank capital and interbank placements. For example, in 2014, BIMB charged impairment expenses of RM59.9 million to both depositors and banks. Non-deductible items are only charged to the bank, which include overhead expenses, salary expenses, depreciation of assets and amortization expenses, general and administrative expenses, general marketing expenses, information technology expenses and premiums paid to the Malaysian Deposit Insurance Corporation (PIDM). For example, in 2014, RM463.5 million of personnel expenses were charged to the bank after deducting income to depositors of RM859.9 million. The FROR also provides guidelines on the use of deposit funds. For example, deposit funds are not allowed to be used to acquire fixed assets and investment in subsidiary or associate companies. They can only be utilized in the provision of financing and advances, investment in securities and inter-bank placements. Based on the above, the CT gives an example on the computation of weighted average rate of return on assets (WAR), as given below:

WAR = (Income /average daily amount of financing) x (365/no of days for the month) x 100%

Suppose income generated from murabaha exposure of RM100,000 = RM850, the monthly WAR = (850/100,000) x (365/30) x 100% = 10.34%. The distribution table (DT) will explain how income generated from the above murabaha transaction (i.e financing with 10.34% yield) is distributed to the depositors and bank respectively.

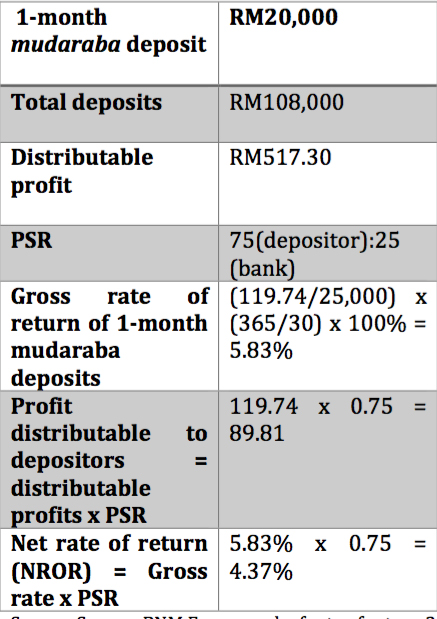

The Distribution Table (DT)

The DT serves to guide Islamic banks on the proper distribution of net distributable income posted on the CT to the respective deposit funds such as current, savings and mudaraba deposits. For our purpose, attention is given to compute the returns on the 1-month mudaraba deposit. Three basic parameters are in play, namely 1) the nominal size of the mudaraba deposit (i.e. 1-month deposit; 2) total size of mudaraba deposits; and 3) the profit-sharing ratio (PSR). Table 3 provides a hypothetical illustration in arriving at the rate of return of a 1-month mudaraba deposit, which serves to assist Islamic banks in their disclosure of income distributed to depositors. The distributable income as given in CT is RM517 with a predetermined 75:25 profit-sharing ratio (PSR) as agreed by the mudaraba depositors as fund providers (rabbul maal) and the bank as the entrepreneur-manager (mudarib). The DT gives RM119.74 as income distributed to the 1-month mudaraba deposits which is equivalent to 5.83 percent per annum. Profit attributable to mudaraba depositors is a proportion of their shares in the contract which is 75 percent of RM119.74 or RM89.81 and equivalent to 4.37 percent per annum.

Table 3: Computation of rate of return of mudaraba deposits summarized in Table 3.

Source: Source: BNM Framework of rate of return 2013.

Computation of Return on Mudaraba Deposits (ROMD)

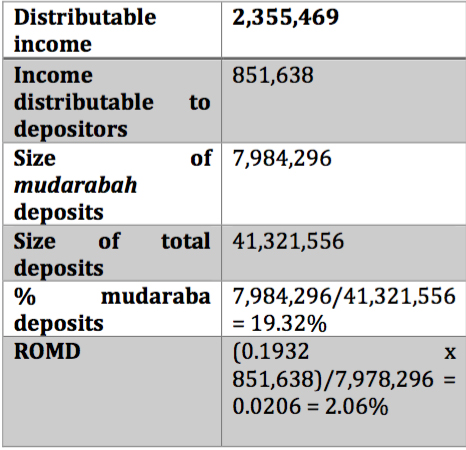

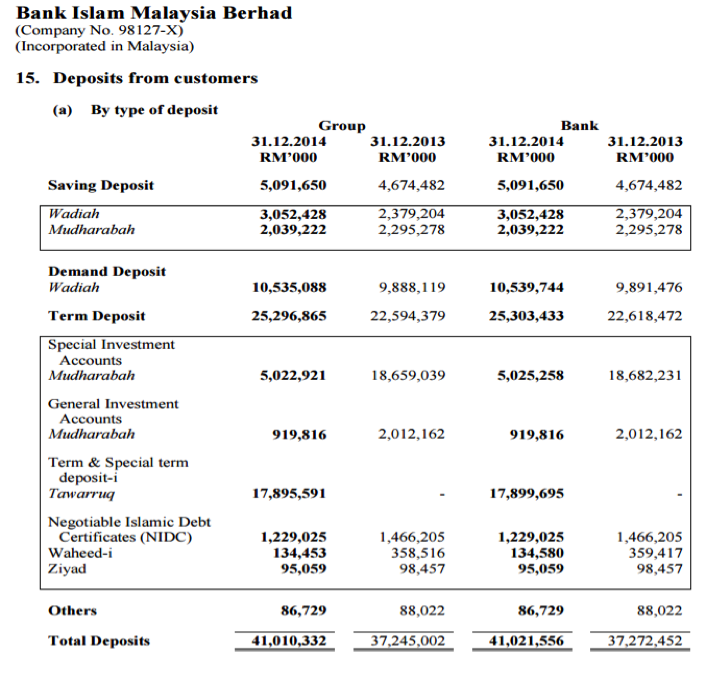

We use Bank Islamic Malaysia Berhad (BIMB) as the case bank in computing ROMD. Data on distributable income and income distributable to depositors is obtained from Table 4 while data on size of mudaraba and total deposits is provided by Table 5. Table 5 gives additional RM300,000,000 from bank placements making up total deposits to RM41,321,556,000. Table 6 gives further information about the deposits. While the NROR and ROMD are not comparable by number, the fact that NROR remains low relative to ROE may indicate that income attributable to shareholders may not be in line with the credit-risk sharing arrangements as specified in the FROR.

As the credit risk is shared by both parties, it is expected that returns on mudaraba deposits (ROMD) will be comparable with return on equity of the bank (ROE). We compute ROMD by dividing the income attributable to mudaraba deposits to size of mudaraba deposits, which is derived from the income statement and balance sheet of Islamic banks. We will illustrate the computation of ROMD by using Bank Islam Malaysia Berhad (BIMB) as a case study.

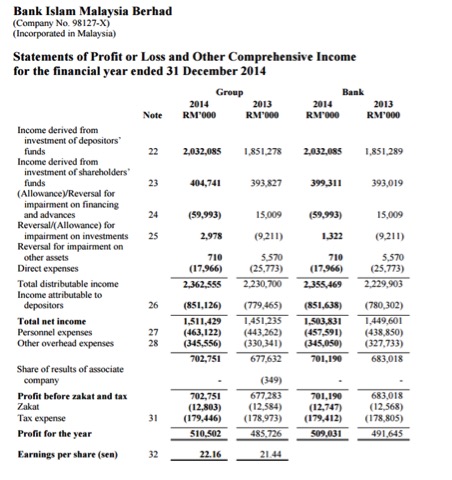

Table 4: Income Statement Bank Islamic Malaysia Berhad.

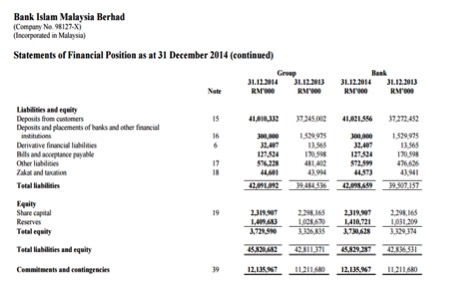

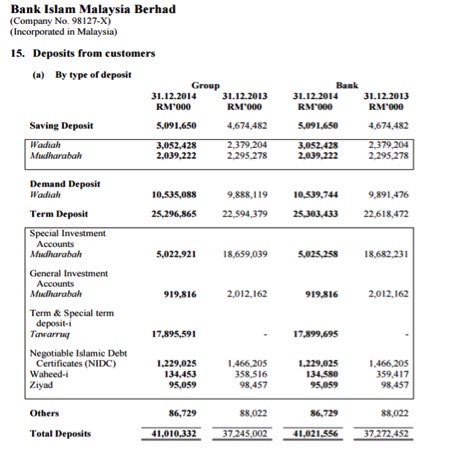

Table 4 above provides two important items in deriving ROMD, namely 1) total distributable income; and 2) income attributable to depositors. Both items were derived based on BNM’s framework of rate of return (FROR) via the calculation table (CT) and distribution table (DT) given in the guideline. BIMB’s bank level data for 2014 are shown in Tables 4, 5 and 6 where total distributable income and income attributable to depositors were RM2.35 billion and RM0.85 billion respectively, total deposits of RM41,021,556,000 and size of mudaraba deposits at RM7,984,286,000.

Table 5: Liabilities – Bank Islam Malaysia Berhad.

Table 6: Deposits- Bank Islam Malaysia Berhad.

As shown in Table 7, ROMD for BIMB at 2.1 percent is obtained based on four items captured from BIMB’s financial report following the format of the FROR. These items are 1) distributable income; 2) income distributable to deposits; 3) size of mudaraba deposits; and 4) total size of all deposits. ROMD of 2.1 percent is obtained by dividing income attributable to depositors to the total size of mudaraba deposits. It means that for every 1 ringgit placed in mudaraba deposits, the depositors get 2.1 sen per annum as return on their investment.

Table 7: Computation of ROMD

Source: Author’s computation.

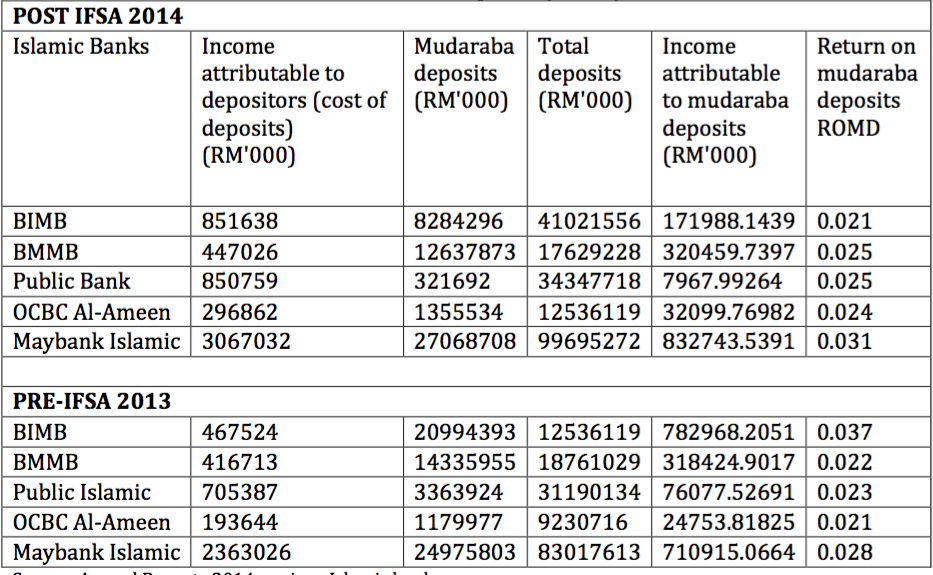

Based on our methodology for computing ROMD, ROMDs for 5 Islamic banks are given in Tables 8 and 9 below. Our methodology of calculating ROMD is based on annual size of mudaraba deposits and the size of profits attributable to it. As the 2014 income statements and balance sheet items of the five Islamic banks are guided by the FROR of BNM, there should be no significant variance between the two methodologies adopted in arriving at NROR and ROMD. The ROMD is computed on annual basis while NROR are based on monthly basis. Thus the numbers presented in Tables 8 and 9 cannot be identical to the bank’s internal NROR. Understandably enough, the author has no access to Islamic banking internal data to compute the NROR. For this reason, we use the hypothetical illustration of computing NROR available from the CT and DT of the FROR.

Table 8: Islamic Banks Return on Mudaraba Deposits (ROMD)

Source: Annual Reports 2014, various Islamic banks.

In 2014 and 2013, the ROMD averages stood at 2.5 percent and 2.6 percent per annum respectively, suggesting returns similar to interest-bearing fixed deposits. Interestingly, as shown in Table 8 the ROE for the five Islamic banks averaged at 12.1 percent and 14.4 percent respectively. This substantial amount of variance between ROMD and ROE can be quite disturbing for the mudaraba depositors whose funds are deemed risky but who were not compensated accordingly to the profit-and loss principle of mudaraba.

Table 9: Islamic Banking ROMD and ROE

Source: Annual Report 2014, various Islamic banks.

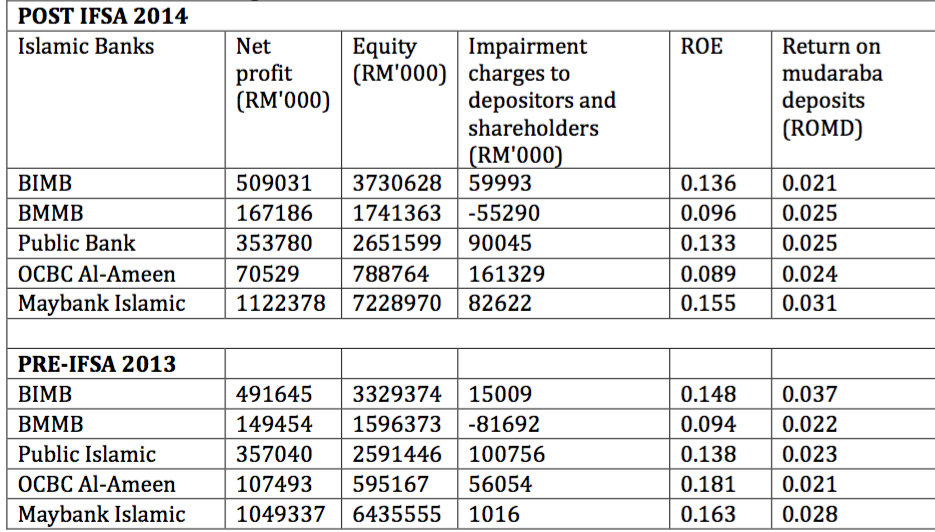

Reports from the Shariah Committees of Islamic banks tend to indicate that the allocation of profits and charging of losses relating to the investment account has readily conformed to the principles of the Shariah. Two samples of such reports from Maybank Islamic and Bank Islamic Malaysia Berhad are shown in Table 5. The charges of losses can mean two things, namely 1) the expected loss (EL) i.e. expenses for financing impairment which are charged to the bank and mudaraba depositors; and 2) the unexpected loss (UL) i.e. write-offs from bad loans/financing that reduces bank’s capital. While it is not common to see mudaraba deposits suffer material depreciation due to bank losses, the charges of impairment provisions to the mudaraba depositors is visible evidence of credit risks taken by them.

Table 10: Shariah Committee Reporting: Maybank Islamic and BIMB 2014.

The fact that mudaraba depositors have received relatively lower returns than shareholders indicates that the distribution of profit was not adequately made in accordance with the taking of loss. This can constitute a breach of Shariah rules which may not be visible in contract law but a practice that defies the legal maxim, al-ghorm bil ghuni which means that profit is acquired with risk. Shariah non-compliance risk (SNCR) is at stake here given that in the distribution of credit risk to banks and the mudaraba depositors, profits were accorded not in proportion to the risk taken.

While we look forward to relatively higher returns for mudaraba deposits over interest-bearing term deposits as the latter (i.e. conventional term deposits) do not carry credit risks, it is highly unlikely to suggest that ROMD equals ROE as the bank’s holding of capital against unexpected loss (UL) implies that it should also be rewarded for the additional risks taken which include market and operational risks. However, this can be quite tricky since the bank whose role as a mudarib (i.e. entrepreneur/manager) is also required to hold regulatory capital against the exposures funded by funds derived from the depositors who served as rabbul-maal (i.e. funds provider). Understandably enough, it is possible for a mudarib to pose a sum of money as a guarantee against loss due to negligence. But this is not what bank capital is for. The role of bank capital is to absorb unexpected losses usually arising usually from systematic risks. The FROR may also need to explain the reasons behind the use of mudarib’s capital (i.e. bank’s capital) in income generation (i.e. income generated from shareholders’ fund) which may disfigure the nature of the mudaraba contract. We also notice that no explanation is given by FROR on the allocation of impairment expenses to the bank and mudaraba depositors. This would leave doubts about the loss absorbing role of the two parties and who primarily absorbs the larger portion of the loss. This is because the PSR can only indicate the sharing of profits and not losses. While losses from credit risk should be carried by the mudaraba depositors, we should expect them to absorb all of the impairment provisions but information on this matter is not explained in the FROR.

Islamic Financial Service Act (IFSA) 2014

One salient feature of IFSA 2014 is the defining of the bank’s funding into deposit funds and investment funds. Prior to this new law, exposures funded by deposit funds had to be backed by regulatory capital even when such deposits were based on mudaraba. As equity funds, investment accounts (IA) are expected to stimulate profit-loss sharing financing and enhance entrepreneurship in the real sector. It can also help reduce the high intensity of credit financing in Islamic banks which is hazardous to the bank in the event of shocks. The introduction of the investment account as a new funding product is expected to free the bank from holding capital against business and financial risks which is now transferred to the investment account holders who should enjoy relatively higher returns in relation to the higher risk taken in the investment. The bank will act as the fund manager which is fee-driven similar to asset management services. The idea is the matching funding and financing risk-appetite of the surplus and deficit sectors respectively, which is not possible when deposit funds are matched with profit-loss sharing financing instruments. IA can be mobilized independently by Islamic banks or they can participate in mobilizing the IA funds via the Islamic Account Platform (IAP) as given in Appendix 1. Participating banks can supply information for companies seeking funding via the IAP where potential investors can choose the projects they want.

The separation of funding is effective from 15 June 2014 after which capital charges will not be imposed on exposures funded by investment account. Islamic banks are, however, given options to convert existing mudaraba deposits into investment accounts or to convert them into commodity murabaha term deposits or any other non-mudaraba deposits such as wakala. Table 9 provides an example of the strategic shift of BIMB funding from mudaraba deposits to investment account and commodity murabaha/tawaruq term deposits. In the transaction accounts, no significant shift from mudaraba to wadiah products is evident, although the former slightly declined from RM2.95 billion in 2013 to RM2.04 billion in 2014. However, substantial shifts from mudaraba to tawaruq term deposits took place where the former declined from RM20.69 billion in 2013 to RM5.94 billion in 2014. This 71.2 percent dropped in mudaraba accounts may signal the problem in mobilizing investment accounts. At the same time, tawaruq term deposits increased from zero in 2013 to RM17.89 billion in 2014. Adverse bank’s risk-appetite policy towards equity financing and lack of demand from funds providers whose risk-appetite remains attracted to fixed deposits, can contribute to BIMB’s funding business model. In other words, the lack of demand for the post-IFSA IA products by prospective fund providers may be due to their liking for pre-IFSA deposit product as opposed to post IFSA investment account products.

Table 11: Bank Islam Malaysia Berhad 2014: Deposits from Customers

The shift from the mudaraba investment accounts to tawaruq term deposits should evidence some changes to the impairment expenses charged to the fund providers. First, impairment expenses will not be charged to the wadiah and tawaruq deposits as these deposits do not carry credit risk, which the bank will carry alone. Secondly, when IA funds are channeled to finance credit sale transactions, credit risk is passed to the IA holders and they will expect to see the matching of return on investment (ROI) to risks as the impairment charges will be made to that specific IA fund alone. This helps mitigate the potential Shariah non-compliance risk evidence in the distribution of profit for general investment account (GIA) and specific investment account (SIA) contracts under mudaraba discussed earlier. The same applies when IA funds are channeled to equity investments. The following discussion based on Tables 10 and 11, attempts to examine the possible impact of returns on funding strategies.

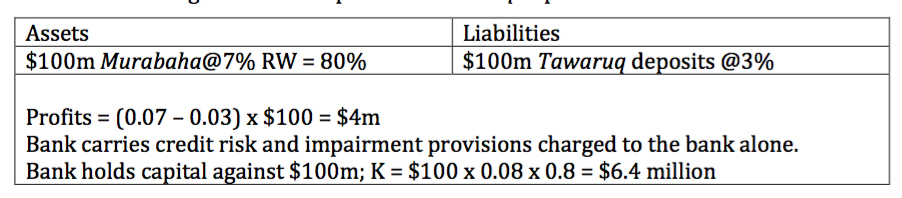

Converting Existing Mudarabah Deposits to Tawaruq Deposits

As we assume a high degree of credit intensity in Islamic banking, tawaruq deposits will be channeled to fund murabaha transactions. By contract, tawaruq deposits are able to stipulate upfront a rate of return, hence the bank’s profit is simply the spread between term charges on murabaha at 7 percent and cost of deposits at 3 percent. The bank carries the risk of default and holds capital against unexpected loss from credit risk. Returns on tawaruq deposits should be similar to conventional fixed deposits as both behave similarly.

Table 12: Shifting Mudaraba deposits to Tawaruq deposits

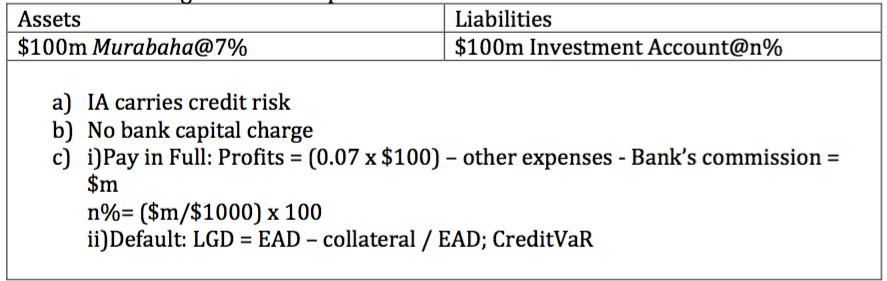

Converting Excisting Mudarabah Deposits into Investment Accounts

When the murabaha financing is funded by investment accounts, the bank does not hold capital against the exposure as all risks are now taken by the IA holders. Hence, in the case of full repayment, the return on investment should be relatively higher than conventional fixed deposits. In the event of default, recovery depends on the collaterals set against the exposures and the remaining balance after default.

We expect that smaller banks may opt for the IA option as practically no capital is required to cushion potential loss from the credit exposures. Bigger banks may choose the tawaruq option in view of the higher spread they can earn from the murabaha. For example, from tawaruq funding at 3 percent, the spread is 4 percent against RM6.4 million regulatory capital. Using IA would mean less income from fees but this is possible without putting bank’s capital at risk.

Table 13: Shifting Mudaraba deposits to Investment Account

Conclusion

When the underlying contract between an Islamic bank and the depositors is based on mudaraba, a profit-loss sharing arrangement is evident by the charging of impairment expenses to the mudaraba depositors. While this is the case, the returns on mudaraba deposits (ROMD) do not seem to reflect the risks shared by both parties as the ROMD has been consistently lower than ROE despite evidencing some form of credit-risk sharing between them. Such discrepancy in performance of deposit funds and capital funds may trigger Shariah non-compliance risk. The introduction of the investment account (IA) in Islamic banking amongst others, should reduce such unwanted risk. When investment accounts (IA) are channeled to fund murabaha transactions, the credit risk should be solely carried by the IA holders and hence, the return on investments accounts (ROI) can be the reference point in assessing the risk-taking activities of investment account holders which is comparable to the return on equity (ROE) of bank’s shareholders.

Prof Dr Saiful Azhar Rosly is currently the Director, Centre of Consulting & Executive Programmes at INCEIF. He currently teaches risk management for Islamic banks and researches on issues related to true-sale Islamic credit financial instruments and Shariah non-compliance risk management. He obtained his undergraduate and Master of Science Degree in economics from Northern Illinois University, DeKalb, USA and Ph.D in economics from the National University of Malaysia. Prof Saiful has published his work in referred academic journals including International Journal of Social Economics, Arab Law Quarterly, Thunderbird Business Review, Managerial Finance, Asian Economic Policy Review, and Journal of International Financial Markets, Institutions & Money. He served International Islamic University Malaysia (IIUM) from 1983 to 2005, before joining the Malaysian Institute of Economic Research (MIER) as Director of Research. He was former Independent Director for EON Capital Islamic Bank (Malaysia) and Federation of Investment Managers Malaysia (FIMM). He formerly hold SAC position at AGRO Bank Bhd and EON Capital Islamic Bank Berhad. Prof Saiful is currently a Shariah Advisory Committee (SAC) member for Prudential BSN Takaful.

References

Bank Negara Malaysia, Framework of Rate of Return 2103

Bank Negara Malaysia, Guidelines on Investment Account 2014

Bank Negara Malaysia, Islamic Financial Service Act 2013

Bank Islamic Malaysia Berhad, Annual Report 2014

Bank Muamalat Berhad Malaysia, Annual Report 2014

Maybank Islamic, Annual Report 2014

Public Islamic Bank, Annual Report 2014

Rosly S.A. & Zaini A.S, Risk-Return Analysis of Islamic banks investment deposits and Shareholders funds, Managerial Finance, Vol 32, No. 10, 2008

OCBC Al-Amin Malaysia, Annual Report 2014

UOB, Annual Report 2014

Appendix 1